Niche Market Leadership for Higher Profits in the Valve Industry

Niche Market Leadership for Higher Profits in the Valve Industry. (Image source: The Mcilvaine Company)

Much of the value is in lower total cost of ownership. This is the result of R&D which may have been expensed long ago.

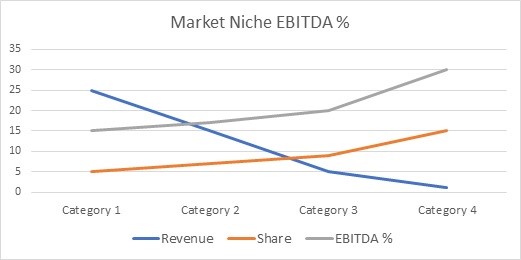

Since the price advantage is not due to lower cost of production. EBITDA rather than EBIT is a better indicator of the success of higher performance valves. it reflects performance superiority rather than investment to lower manufacturing cost (the average valve company cost which in turn would be reflected by higher depreciation).

Valve companies average EBITDA of less than 20% IDEX is a leader with 30%. Emerson EBITDA is 25%.

It has been shown that EBITDA and niche market leadership are correlated.

The largest valve company has less than 6% of the total valve market. But it has 10% of the power market in the Americas. It has 15% of the power-Americas-severe service-control valve market. This leadership disproportionately contributes to high EBITDA as shown in the following graph.

The average valve company has only a fractional percent of the total high performance valve market. But in niches some of these companies are market leaders with 10% share. It is in these niches where 30% EBITDA is achievable.

The McIlvaine company forecasts the very narrow market niches on a custom basis. But it maintains millions of forecasts with the level of detail shown below for Emerson.

Acquisitions which boost total EBITDA % rather than just EBITDA revenue should be pursued. McIlvaine is continually updating an acquisition database along with market shares.

Source: The McIlvaine Company