Drive Suppliers Facing Supply Problems Across the Board

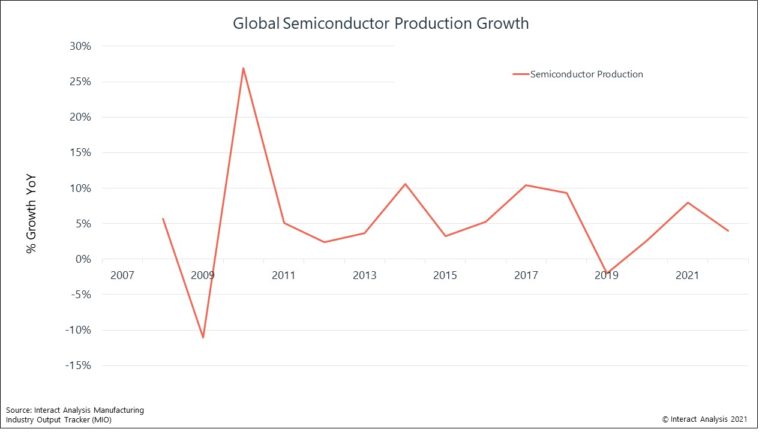

Global Semiconductor production increased from 2020 and continued to grow into 2021. (Image source: Interact Analysis)

Global shutdowns hindered production universally, leaving manufacturers unprepared to meet the new wave of increased demand. Virtually all motor-drive components are experiencing shortages and/or an increased price point. This means that lead times and prices are rising as drive suppliers work to protect what margin they can while continuing to serve core customers.

Supply chain issues: from semiconductors to cardboard

The semiconductor shortage is at the forefront of current affairs and is a major concern for drive suppliers. Increased demand for semiconductors in 2020 while facing shutdown related production challenges caused difficulties in supply. Now, as many major economies return to a sense of normalcy, demand has begun rising even more sharply while supply capability continues to lag. Couple this phenomenon with several supply shock events such as the Suez Canal blockage and a major fire at a key production facility, and it becomes abundantly clear why the semiconductor supply is in its current state.

Global semiconductor production increased during 2020 despite COVID-19. It has continued to grow in 2021 although the industry has still been unable to produce at levels which satisfy demand

In addition to majorly impacting the supply of IGBTs, the semiconductor shortage has also impacted the availability of the microprocessors used in drives. General purpose drives tend to be less sophisticated and rely on simpler microprocessors as compared to premium drives. Although we are still in the early stages of research, it seems that the general-purpose drives are more protected from the impact of the semiconductor shortage as their components are more easily sourced. In contrast, microprocessors in high performance drives are more difficult to source leading to bottlenecks in production. We predict that due to the semiconductor shortage, the product mix in the drives market will skew toward general purpose drives while high performance drives face component sourcing issues. We expect this to be a short-term issue that will resolve as supply chains normalize. Outside of semiconductors, the supply chain is experiencing price hikes for basic materials including steel, copper, and even cardboard.

Both trends have left drives suppliers resorting to spot buying in order to procure the components and materials needed to meet demand. One work around to filling demand which is gaining increased traction is reliance on re-branding. Suppliers which have performed better through these supply shock events have found, for the time being, a new revenue stream in offering drives for rebrand to suppliers struggling to produce.

The great container shortage and other transportation woes

Another elephant in the room when discussing issues in the current economic climate is the cost of transporting goods. Drives vendors have reported difficulty securing containers for transport as well as double digit increases in transportation costs. Brought on initially by surging post-COVID demand, the cost of transportation was undoubtedly exasperated by the Suez Canal incident. According to the FBX container price index, the price for a 40ft container has increased nearly 3-4x over last year having recently crested $6,000. Rising transportation costs coupled with component shortages have caused drive suppliers to pass the cost to the consumer, raising drives prices anywhere from 2-5 percent.

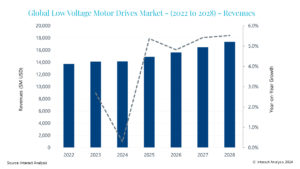

Source: Interact Analysis