Driving Innovation: The evolution of low voltage AC Drives towards compact, multi-axis, integrated solutions

Image source: Interact Analysis

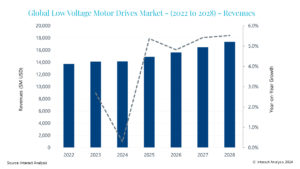

More specifically, demand for more modular, compact machinery has increased innovation within the drives market, leading to the development of space-saving solutions. This insight will explore several innovations in the low voltage AC drive market, namely multi-axis drives, integrated motor drives, and wide-bandgap semiconductors, as well as their potential impact on the market.

Compact multi-axis drives revolutionize machine design and flexibility

The concept of multi-axis has historically been a defining characteristic of servo drives and was not commonly associated with low voltage motor drives. However, recently released offerings from Delta Electronics and Inovance have changed that. At SPS 2022, Inovance unveiled the MD-800 compact multi-axis drive, while in August of the following year, Delta Electronics announced the release of the MX300.

These drives enable one drive unit to control multiple motors. According to Delta Electronics, a single rectifier module can support up to 6 inverter modules and control up to 15 axes. This represents significant space savings when compared with traditional one drive to one motor setups. Delta Electronics and Inovance state that utilizing these compact multi-axis drives can save 50% of space within a cabinet, facilitating easier installation. As a result, this product type allows for a much higher level of flexibility in machine design.

We observed a similar trend in our inaugural study on ultra-low voltage (<60v) drives. The previous emphasis on designing machines for optimal efficiency to achieve high throughput has shifted towards designing flexible machines. Our analysis indicates that the compact multidrive product type might be poised to become a competitor of decentralized and motor-mounted drives in applications and processes requiring additional flexibility.

Development of High-Efficiency Motors Fuels Integration Trend

In the same vein of enabling greater machine flexibility, the integration of drives and motors has long been discussed in the low voltage AC drives market. While this trend has been prevalent at low power ranges with electronically-commutated (EC) motors (not within the scope of our current research), some players are making strides towards integrating higher-powered motors and drives.

Rockwell Automation and Infinitum recently announced a joint venture to develop a new class of high-efficiency, integrated low voltage drive and motor technology. Their collaboration, which pairs Rockwell’s PowerFlex drive technology with Infinitum’s ultra-high-efficiency air core motor system, aims to build a product that saves energy and cuts costs for industrial customers while helping them to become more sustainable. The integrated motor system is expected to be 50% of the size and weight of a traditional motor system, effectively reducing the drive’s footprint.

Historically, the main challenge for integrating motors and drives at higher power ranges has been excessive heat generation. Recently, however, wide-bandgap semiconductors have been cited as a promising solution to this issue.

Challenges and opportunities for wide-bandgap semiconductors

Characterized by a large energy gap between their valence and conduction bands, wide-bandgap semiconductors offer several advantages over their traditional counterparts. The ability of these semiconductors to operate at higher temperatures, voltages, and frequencies makes them ideal for applications in power electronics, such as electric vehicles, renewable energy systems, and high-frequency communication devices.

With the rapid adoption of electric vehicles increasing demand for wide-bandgap semiconductors, there is a much greater supply of wide-bandgap semiconductors available than ever before. However, despite an expanding supply, wide-bandgap semiconductors are still not price competitive compared to their traditional counterparts. Silicon-carbide mosfets can cost up to 3x the price of standard silicon ones. As a result, implementation of wide-bandgap semiconductors within drives is still sparse.

However, as supply increases, we expect pricing to trend downward over time, making wide-bandgap semiconductors a more attractive prospect for drive vendors. Moreover, we have observed drive vendors moving toward in-house production of power-semis. With its acquisition of Semikron in 2022, Danfoss has become a manufacturer of power semis and produces SiC-based semis. Additionally, according to McKinsey and Company, Mitsubishi Electric currently produces SiC power semis. It is estimated to have 2% of the current market for SiC, although all of its supply is allocated for internal use. If this type of in-house production continues, it is likely to see the use of wide-bandgap semis expand more quickly across the market.

Final Thoughts

Multi-axis drives, integrated motor drives, and wide-bandgap semiconductors are three examples of innovative solutions that are transforming the market. These solutions offer significant space-saving benefits, higher levels of flexibility in machine design, and better energy efficiency. While the scalability of wide-bandgap semiconductors remains a challenge, the long term trend points to increased adoption within motor drives as a means to facilitate development of more modular, compact machinery.

Source: Interact Analysis