Innomotics: Who Will Purchase this Motor Giant?

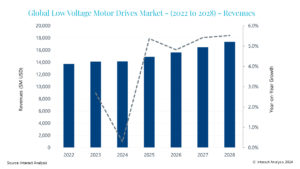

Image source: Interact Analysis

In 2022, Siemens announced its intention to separate its motors division, large drives division, and a handful of other related divisions into a separate entity: Innomotics. In November of last year, the company quietly took this a step further and announced in a press release that it is preparing Innomotics for sale and is actively seeking a buyer.

The sale of Innomotics would represent another example of significant M&A activity within the low voltage motor market. In 2022, Siemens announced the sale of its NEMA division to ABB. A year later, WEG announced the acquisition of Regal Rexnord’s Industrial electric motors. While these acquisitions were significant, they pale in comparison with the scale of the sale of Innomotics. The third largest player in the LV AC motor market, the newly established entity is estimated to have approximately €3 billion in total revenue and over 15,000 employees.

As we review Innomotics, we are left wondering: who will purchase this motor giant? Below, we investigate key possible suitors and assess where they stand regarding the potential acquisition of Innomotics.

Competitive motor suppliers

In considering potential purchasers, notable motor vendors such as ABB, WEG, Nidec, and Wolong emerge as key contenders. Each of these companies would stand to gain from increased market share and expanded capacity. However, there are uncertainties regarding approval from the European Commission for such acquisitions within the EU.

ABB

ABB, a prominent motor supplier with a heritage dating back over 130 years, was formed in 1988 through a merger of industry powerhouses. Competing in various sectors, including electrification and automation, ABB has consistently ranked among the top motor suppliers for many years. ABB is no newcomer to acquiring major motor suppliers and in 2011 made its largest acquisition to date, acquiring Baldor Electric for over $4 billion.

Pros

- In recent years, ABB has actively competed for market share, striving to secure and retain its position as a global industry leader. A substantial acquisition of a major competitor would firmly cement its position as the largest motor supplier in the world.

- With a proven track record of managing substantial acquisitions, ABB, having paid $4 billion for Baldor in 2011, is well-positioned to navigate and capitalize on the opportunities presented by the potential acquisition of Innomotics.

- ABB is widely recognized for delivering high quality motor products. Siemens, similarly, has a well-established reputation for its motors. The similarities in these product portfolios would further strengthen ABB’s image as a premium vendor.

Cons

- ABB’s potential acquisition of Innomotics may face scrutiny under the EU’s antitrust policy, designed to prevent anti-competitive practices and maintain a fair market. The European Commission is likely to conduct a thorough evaluation of the acquisition’s impact on competition within the EU motor sector. An acquisition of this scale would award ABB a nearly 30% share of the low voltage AC motor market across the EMEA region.

- The potential acquisition of Innomotics, valued at €3 billion, prompts questions about ABB’s financial readiness. The magnitude of the investment raises questions about ABB’s willingness to allocate a significant portion of its financial resources to this acquisition. Shareholders and investors may scrutinize the financial implications.

- Furthermore, considering the recent finalization of its acquisition of Siemens’ NEMA division, ABB might well be in the process of integrating it into its operations. This ongoing integration could potentially divert resources, attention, and management focus. Undertaking another major acquisition like Innomotics in close succession might strain ABB’s internal resources and impact the smooth integration of both acquisitions.

WEG

WEG, established in 1961, introduced electric motors as one of its first offerings. With over 60 years in the motor industry, WEG has grown and expanded outside of South America to be the second-largest motor vendor globally. A well-established giant, WEG has a history of being strategic with its motor acquisitions. WEG’s most recent motor acquisition was that of Regal Rexnord’s Industrial Electric Motors and Generators business in mid-2023.

Pros

- If WEG purchases Innomotics it would enable the company to gain a significant foothold in both EMEA and APAC – two regions where WEG has been historically weak (relatively speaking).

- While currently sitting in second place in the low voltage AC motor market rankings, WEG would leap into the number one spot by a significant margin with an acquisition of this size. The revenue from Innomotics would nearly double WEG’s market presence.

- Acquiring Innomotics, a historically European-centric business, would allow WEG to access an extensive distribution network in the EMEA region that it has not previously had. Recent moves by WEG, including the expansion of a manufacturing plant in Turkey, show an appetite for the company to increase its presence within the region.

Cons

- While WEG has a history of acquiring other motor vendors, its acquisitions have historically been “fire sales”. For years, WEG has been able to capitalize on securing businesses that others may be trying to get rid of. WEG’s past success in capitalizing on distressed businesses may not align with Innomotics’ premium price point.

- With the deal still pending closure, WEG’s recent announcement of the acquisition of Regal Rexnord’s Industrial Motors and Generators business introduces the potential for internal pushback in starting another acquisition so quickly.

- One considerable difference between the two companies is the product mix. WEG’s business model seems to rely on simplicity and an abundance of motors, while Innomotics focuses on customer customizability. Integrating these two starkly different approaches may pose a challenge. However, it could also present an opportunity for WEG to diversify its product offering in the future.

Nidec

Nidec, founded in 1973, is a motor pioneer. With a global foothold, the company has established itself as a top motor vendor, holding the 4th spot globally. Nidec has a long-standing history of acquiring vendors, with one of its most recent being Emerson Electric’s Motors division and its French counterpart Leroy-Somer.

Pros

- Although Nidec is a major player in the EMEA region, it currently holds less than 10% of the market. This gives it an advantage for potential acquisition approval under EU antitrust policies.

- Acquiring Innomotics would give Nidec access to a motor line that is relatively similar in terms of product offering, potentially facilitating a smoother integration between the two companies.

- Nidec’s revenue in the EMEA region would benefit heavily from the acquisition, as Innomotics has the highest share in the region. This could make Nidec’s revenue in the EMEA region similar to that of its Americas division.

- While other vendors have made recent acquisitions in the motor sector, Nidec’s most recent major acquisition was Emerson and Leroy-Somer in 2017.

- Nidec has a long-standing history of making acquisitions and using them to expand its business. In its 50 years of operation, it has made 73 acquisitions, so it is not shy when it comes to acquiring other entities.

Cons

- Nidec operates across various sectors, with motors constituting just a fraction of its overall business. This prompts the question of whether Nidec views the motor sector as a strategic priority for significant investment, especially given its diverse business portfolio.

- Nidec’s motors business faced a loss in market share in 2022, adding a layer of uncertainty to the acquisition of a large entity like Innomotics.

Wolong

Established in 1984, Wolong, although a relatively recent entrant into the industry, has swiftly ascended to the fifth position globally in the motor market. Despite its relatively short history, the company boasts a unique approach to acquisitions – unlike many others, Wolong strives to retain the brand identity of businesses it acquires, with GE Industrial Motor being a prime example.

Pros

- Wolong is strongest in the APAC region and has also been making progress in expanding in other regions. Having a <5% share in EMEA in 2022, the potential acquisition of Innomotics would significantly help it to grow in this region. It would also award the company the top spot in the APAC market.

- One of Wolong’s notable strategies is its history of preserving the identities of acquired motor vendors, such as ATB group and GE Industrial. This approach respects the heritage and legacy of these companies while fostering trust and continuity within the customer base. Innomotics, with its strong reputation from Siemens, could find value in maintaining brand identity.

- An acquisition of Innomotics might represent an opportunity for the company to further its ambitions to become a top motor drive vendor. Wolong is particularly strong in medium voltage drives and motors and so the large drives portion of Innomotics offering could represent “the icing on the cake”.

- Wolong can be described as a hidden dragon in the motor market, having slowly crept up towards the top of the global suppliers list. The company has utilized a strategy of international expansion through acquisition and the sale of Innomotics represents a strategic opportunity to expand further internationally.

Cons

- One potential challenge for Wolong in acquiring Innomotics lies in the strong ties the German company has with its customer base. The customer base may be hesitant or resistant to continuing to do business under new ownership, given the pride and loyalty associated with Innomotics’ historical roots.

- Compared with the other companies we’ve examined above, Wolong has the lowest revenue in the motor market. If it was to acquire Innomotics, it would effectively triple its global revenues.

- Additionally, Wolong faces market challenges in China, where ongoing price erosion in the motor market is anticipated to persist throughout 2024. This economic climate may raise questions about the timing and justification for such a sizable acquisition.

Non-motor suppliers

Danfoss

While Danfoss is not a motor supplier, the company has a rich history of operating in similar spaces to Innomotics. The company, dating back to 1933, has established itself as one of the top vendors in the low voltage drives space. The company has made acquisitions as large as $3.3 billion to expand its reach.

Pros

- Danfoss, recognized for its reliability and top-notch products, aligns well with the quality associated with Innomotics. This shared commitment to product standards could foster a seamless integration of operations and enhance the overall product portfolio.

- Acquiring Innomotics would represent a strategic expansion into the medium voltage drives sector and also an entrance into the motors business for Danfoss. This expansion into new areas could open up additional revenue streams and strengthen Danfoss’s position in the market. It would also serve as a rounding out of its industrial portfolio.

- Integrated motor and drive offerings are becoming more commonplace and this trend is expected to progress over the next decade. Adding motors to Danfoss’s portfolio could help to future-proof its offering.

Cons

- Given Danfoss’s recent substantial acquisition of Eaton Hydraulics in 2021, there may be concerns regarding the availability of funds or backing for another significant purchase.

- The introduction of motors to the Danfoss portfolio would represent a significant strategic move. Such substantial changes are not undertaken lightly and may pose challenges in terms of operational adjustments.

Initial Public Offering (IPO)

While the goal seems to be selling Innomotics to a third party, Siemens has explicitly stated that an Initial Public Offering (IPO) is also under consideration. An IPO poses both challenges and opportunities for those within Innomotics, with a significant concern likely to be around dispersed decision-making among a broad shareholder base. Conversely, an IPO can serve as a morale booster, maintaining a sense of ownership within the company rather than a competitor acquisition.

Final Thoughts

As we wait to see what the future holds for Innomotics, it is clear that the motor market is about to undergo some significant changes. With each option discussed having potential benefits and hurdles to consider we can only speculate on what is to come for Innomotics. While a motor vendor is a likely suitor for an acquisition, it is equally plausible that private equity firms or other industrial-focused companies are considering bidding for the business. In any case, we expect we will find out soon who is willing to acquire this motor market juggernaut.

Source: Interact Analysis