Strategic Analysis of the Indian Pumps Market

Although the global financial crisis had moderately impacted the Indian pumps market, growth factors such as a better economy, increasing middle class, rapid urbanization, and expanding infrastructure needs are expected to coerce demand over the coming years.

Government initiatives in infrastructure development are likely to encourage growth in the key end-user sectors. With India’s gross domestic product (GDP) increasing at a rate of 8.0-9.0 percent and the Government’s thrust on infrastructure and urban development through projects such as Jawaharlal Nehru National Urban Renewal Mission (JNNURM), high growth is anticipated in the end-user sectors, including metals and mining, cement, power, water supply, and wastewater.

New analysis from Frost & Sullivan, Strategic Analysis of the Indian Pumps Market, finds that the market earned revenues of INR 49,736.1 million during FY 2010 and estimates this to reach INR 146,209.9 million by FY 2016.

“Depleting groundwater levels, decreasing supply of uncontaminated water, and unreliable monsoons have increased the demand for water pumps,” says Frost & Sullivan Research Analyst Madhu Krishna Reddy. “With the prevalent drought conditions in many arid states due to inadequate rainfall, groundwater levels have been depleting at a rapid pace; this is expected to trigger the demand for pressure boosters and deep well submersible pumps to draw water from greater depths.”

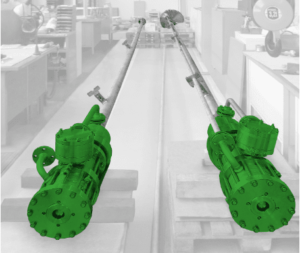

Increased investments in the irrigation and oil and gas sectors will create an upsurge in the demand for pumps. Deregulation of the exploration and production industry with the New Exploration and Licensing Policy (NELP), planned increase in the refining capacity, huge investments in the petrochemical industry and irrigation projects, among others, are poised to fuel the demand for pumps. Global companies spread across the end-user sectors, small- and medium-sized manufacturers, as well as local and niche segment participants are emerging in the Indian pumps market.

While the pumps market is anticipated to witness a high double-digit growth in the near future, factors associated with large unorganized manufacturers, free/subsidized electricity provided to the agriculture sector, long product life cycle, and counterfeits and political instability are likely to lead to delays or cancellation of government-aided projects and impede the possibility of higher growth rates.

The Indian pumps market has witnessed minimum technological advancements. Most pump manufacturers in the unorganized sector are niche-focused and manufacture products that cater to the specific demand of end users. They have predominant presence in the highly price-competitive agriculture and domestic sectors. As a result, these small-scale manufacturers promote their products mainly leveraging on low price, with limited focus on R&D activities.

To cater to customer demand for cost-effective solutions, pump manufacturers must provide integrated solutions. Though the initial cost of implementing an integrated solution package is high, end users have started considering the benefits over the long term.

“Only a few indigenous large-scale suppliers and multinational companies are able to offer customers with these cost-effective solutions,” says Virein Kumar Yadlapalli. “This is a challenge for most of the small- and medium-scale manufacturers, as they lack the required capital resources and technical expertise.”

To ensure market progression, there is a pressing need to ramp up awareness levels of end users about the cost benefit parameters associated with the deployment of these solutions. Enforcement of regulations, which mandate the adoption of such effective technologies, will also help improve the situation.

Source: Frost & Sullivan