Low Voltage AC Motor Market Grew by 21.2% in 2022

Revenues Graph (Image source: Golden Brain)

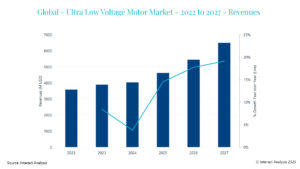

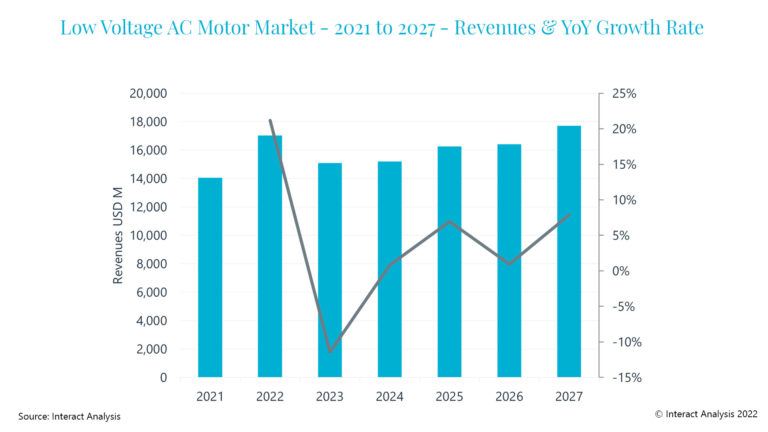

Updated research from Interact Analysis shows that the low-voltage (LV) AC motor market has fared well in terms of growth over the past few years, largely as a result of higher prices. In 2022 alone, the market grew to $17 billion with prices increasing by around 35% to 40% in the first half of the year.

- In 2022, the low-voltage AC motor market grew to a total of $17 billion; driven heavily by price volatility.

- Following regulation going into effect in 2021 in many regions, IE3 motors are now the largest efficiency class in the market.

- IE4 motors are growing significantly during our forecast as the EU rolls out legislation for the product class in 2023.

As prices rose exponentially in 2022, this allowed for a 21.2% growth rate for the LV AC motor market this year. However, it is expected that a slight price decline in the second half of the year will have a knock-on effect on revenue and growth rates. Looking out to 2023, price declines will continue but the volume sold looks set to remain high, matching the 2022 rate. Overall, growth is expected to slow but not fall, as the current economic climate and high interest rates are likely to influence demand for LV AC motors, particularly within the machinery sector.

LV AC Motor market experienced exponential growth in 2022 which is to decline significantly in 2023.

The demand for motors tends to mirror the performance of the manufacturing sector. In 2023, LV motors market growth is projected to slow to around 0.29% in unit sale terms, with revenues falling by >10% due to reciprocal price decreases. The manufacturing sector is also likely to experience slow growth in 2023 because of high interest rates and economic uncertainty caused by the Ukraine-Russia war. Many customers are thought to have overstocked in previous years and the motor market is emerging from this period of exponential demand. Taking a longer term look at the market, it is anticipated that 2026 will see a year of economic decline affect sales.

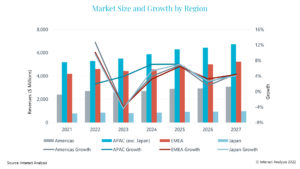

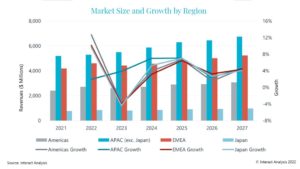

Adoption of IE4 motors has been well received by EMEA and legislation regulating the efficiency of motors in the EU continues to be a driving force for the market. While EMEA has tended to produce the highest priced motors, IE4 legislation has pushed prices up further and has also forced other regions to increase the prices of their LV AC motors. By 2027, almost 30% of market revenues in EMEA regions will come from IE4 motors, in part because all 75kW and 200kW motors must be IE4 compliant in 2023. However, the situation in the Americas regions is very different due to a lack of regulation concerning IE4, with average selling prices likely to remain stable out to 2027 as they currently sit just behind that of the EMEA region. The APAC region currently holds the lion’s share of the LV motor market revenues but there is little in the way of regulation for IE4 motors. The majority of motors produced in the region are IE3 compliant and APAC looks set to be the largest market for lower efficiency motors out to 2027.

Blake Griffin, Senior Analyst at Interact Analysis comments, “Perhaps the most prominent finding we have from this report is the impact that price volatility is having on market growth. In our previous report, we expected prices to rise to a certain level and stagnate for a few years before declining. We have seen the opposite. The motor market is currently experiencing extreme price volatility and changes in the global economy, making forecasting very difficult. We can, however, confidently predict that prices will decline from 2023 onwards before they begin to stabilize in 2026/2027.”

Source: Golden Brain