Geared products market to grow by 7.2% in 2022

(Image source: Golden Brain)

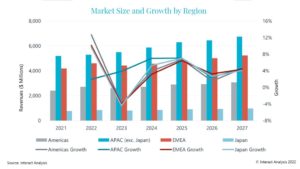

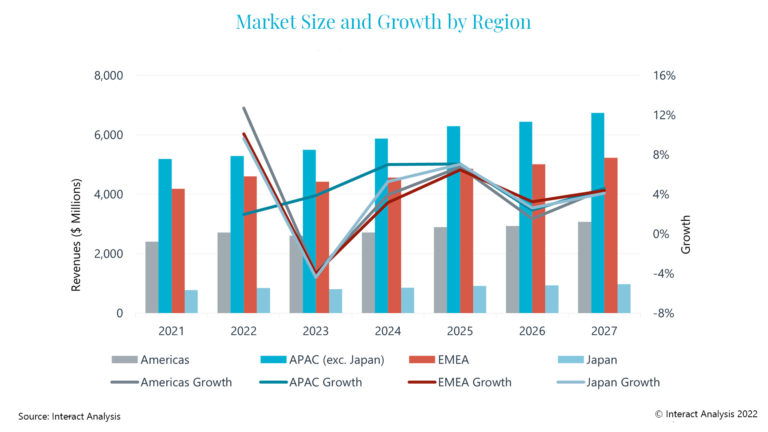

Steady growth has also been seen in 2022, with sales expected to increase by 7.2%. Following a slowdown in sales this year from 2021’s rapid growth rate, 2023 is expected to see sales decline by 0.9%. This fall in sales is likely to be due to a price decrease and a slight downward trend in the number of units sold from the previous year(s). Steep drops in commodity and freight costs in 2023 are expected to push down prices significantly. Regionally, APAC is expected to maintain its lead in the geared products market out to 2027 with a CAGR of 4.5%. The main driving forces behind this are the growing demand for industrial automation in emerging Asian countries, as well as increasing growth rates of manufacturing industries. Following behind the APAC region, the Americas market is predicted to experience a CAGR of 4.1% from 2021 to 2027, while the EMEA region is forecast growth of 3.8% over the period in question.

In terms of application, machinery manufacturers are the major consumers of geared products. They accounted for 74% of sales in 2021 alone, a market share that is anticipated to remain stable throughout the forecast period. Food and beverage industries are particularly heavy users of the technology, while demand for geared products from the conveyor segment is rising, accounting for 25% of sales to the machinery sector in 2021 and anticipated to grow at the fastest pace of all market segments due to rising demand for factory automation.

Shirly Zhu, Principal Analyst at Interact Analysis, comments, “When it comes to the company leading the global market for geared products which – SEW retains its top position. Overall, the market share tables remained very stable in our research with little room for maneuver. Although four of the top five vendors are based in Europe, they have a strong global presence. In EMEA and Japan local vendors appear to be performing the best, while SEW and Guomao are very much leaders in the rest of the APAC region. Elsewhere, Sumitomo has a significant market share, particularly in the US, and Regal Rexnord is also one to watch out for.”

Source: Golden Brain