Global Geared Motors and Heavy-duty Gears Market reached $12bn in 2021

Market Size and Growth by Region (Image source: Golden Brain)

In this edition, amidst global macroeconomic uncertainty, market trend projections have become more volatile compared to previous years.

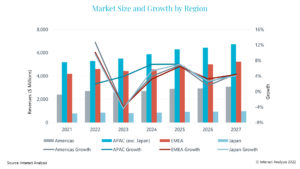

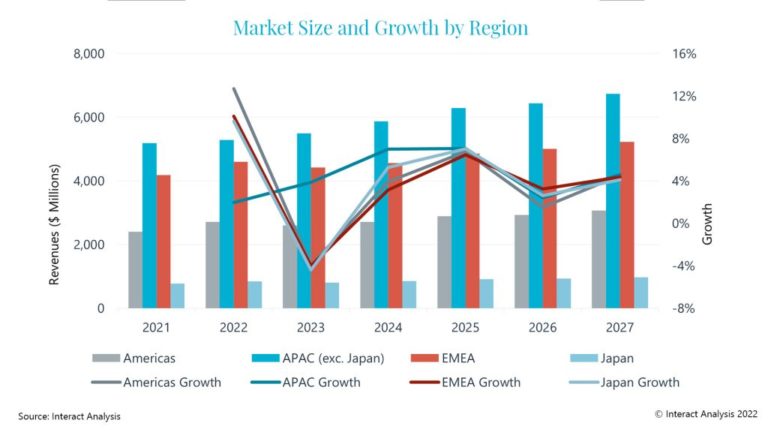

Market outlook varies across regions

In general, global sales revenue of geared products have seen strong rebounds in 2021 and 2022, with estimated year-on-year growth rates of 16.1% and 7.2% respectively. But the revenue is expected to decline in 2023 by 0.9% and resume growth amid fluctuations from 2024 to 2027. The average selling price has been increasing substantially for two consecutive years but is also predicted to start to fall in 2023. These trends of sales and prices, vary widely across the four major regions defined in our scope, the Americas, Asia Pacific (excluding Japan), EMEA and Japan.

APAC (exc. Japan) is likely to be the only region that will see growth in sales in 2023 (3.9%), as China is predicted to recover from the massive lockdowns in 2022. However, this recovery will likely remain weak, as the lingering pandemic has hit the economy hard and concerns about zero-Covid policies have created uncertainty around Chinese domestic demand.

Europe, Middle East and Africa (EMEA) is the only region with a predicted price increase in 2023 – by 1.8%, due to the rising energy costs. However, EMEA is also estimated to encounter the most obvious contraction in unit sales in 2023, by 5.7%. The energy crisis in Europe has dampened demands especially from high energy-consuming industries. Overall, the revenue for geared products in the EMEA market is predicted to decline by 4%.

Over the forecast period, up to 2027, APAC (excluding Japan) is projected to lead market growth with a CAGR of 4.5%, driven by the accelerating pace of industrial automation in emerging Asian countries. The Americas market is expected to grow with a CAGR of 4.1%, driven by the big, stable economies. The expected CAGRs for Japan and EMEA are 3.9% and 3.8% respectively.

Prices predicted to decline after two years of increase

In the global geared products market, price rises were prevalent in 2021 and have become even more dramatic this year. For each product segment, the average selling price will increase by an estimated 8%-9% in 2022. Costs for raw material and transportation have increased substantially since 2021 and remained high in the first half of 2022. In addition, energy prices in Europe and supply chain issues in the US have been pushing prices up. Many geared motor and gearbox suppliers had to announce price increases several times in 2021 and throughout 2022.

Since the second half of 2022, cost pressure began to gradually diminish. By November, both global copper prices and the container freight index have fallen back to January 2021 levels. Considering the weaker demand going into 2023, raw materials and transportation costs are unlikely to return to this year’s highs. However, energy costs will still play a big role in raising prices, especially in Europe. We therefore estimate an overall slight decline of -1% in the global average selling price of geared products in 2023. In the longer term, when the macro environment and upstream prices stabilize, we believe price erosion out of competition will continue as in normal years.

Automation and energy-related sectors predicted to perform well

Dynamics in the downstream industries are shaping demands for geared products. Warehouse and parcel, power, mining and conveyors are the four industries that are expected to increase demand for geared products the fastest out to 2027. Driven by energy shortages and record-high metal prices, Mining and Power industries spiked in 2022. The effects of the boom are expected to last into 2023, while the outlook for demand from other heavy industries is gloomy due to energy saving and emissions reduction goals. Among downstream applications of light-duty gears, demand from the emerging warehouse and parcel sector will remain healthy over the total forecast period. The accelerating factory automation process is also driving demand for conveyors used in material handling. Overall, predicted CAGRs for light-duty and heavy-duty geared products are 4.4% and 3.4% respectively. Planetary gears are predicted for 4.6% CAGR out to 2027, driven by the promising wind turbine sector.

Source: Golden Brain