Interact Analysis: Updated Report on Post-COVID Industrial Landscape

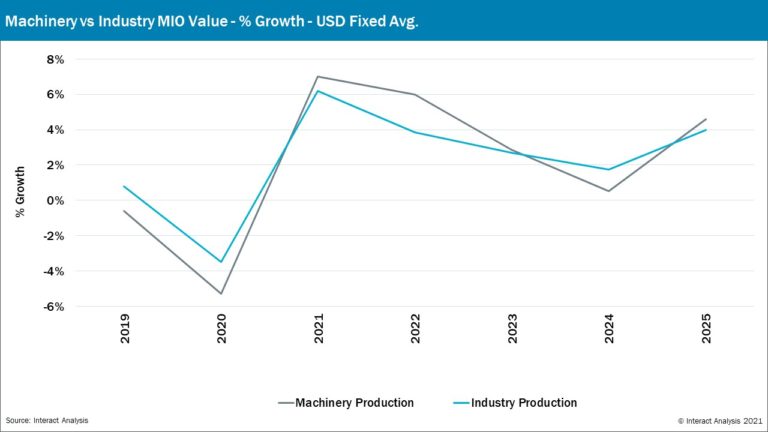

Machinery vs industry MIO value percent growth – USD fixed average. (Image source: Interact Analysis)

Good performances by the US, South Korea and China are offset by regions such as Europe and Japan, which have struggled with the pandemic but are expected to make a swift recovery, and India and Brazil, which continue to fare badly and are expected to see a slow recovery. Problems in the semiconductor sector are already holding back the manufacturing sector, while inflation is a black cloud on the horizon.

The COVID-19 vaccine roll-out has been uneven, meaning some economies will open up more slowly than others. The EMEA region (Europe, the Middle East and Africa) in particular has fared relatively badly. In February 2021, for example, while the UK registered 89.8 vaccination doses per 100 people, Germany registered only 54.2. France and Italy currently measure 48.6 and 51.9 per 100 respectively. The region saw a major hit to the economy in 2020 with growth slumping by around -10 percent, and the slow vaccination rate will keep growth down to 6 percent in 2021. The US is currently running at around 85.4 doses per 100 people and the economy should be fully open by this summer, turning a relatively modest negative manufacturing growth of -3.7 percent in 2020 into positive expansion running at 6.4 percent in 2021. The terrible news coming out of India means that recovery is going to be slow, likewise Brazil, both having the daunting task of turning around from double digit manufacturing declines in 2020 (India: -12.6 percent; Brazil: -15.8 percent). They are both projected to achieve a relatively modest year on year growth of around 6 percent in 2021. China is the only country that saw positive manufacturing growth in 2020 (1.9 percent) and is now back to normal levels of production, in spite of a limited vaccine roll-out.

A combination of factors has led to a serious shortage of microchips, with major repercussions for the electronics and automotive sectors, and a consequent knock-on effect for industrial automation companies. This is hampering recovery in many regions. In the longer-term, the research shows that the current period of unusually strong semiconductor growth as a result of the shortage will be followed by a crash in the market sometime around the end of 2023 or the beginning of 2024. This is being driven by two factors: semiconductor companies are investing in new capacity to deal with current elevated demand, and semiconductor customers are currently stockpiling and will soon have more than they need.

Adrian Lloyd, CEO at Interact Analysis, comments: “These have been incredibly difficult times for the global manufacturing sector, and we’re by no means out of the woods yet. The chip shortage will continue for some time to come. Furthermore, the vast scale of quantitative easing and financial support that was applied by governments during the pandemic, amounting, for example, to a massive 54.5 percent of GDP for Japan, and 39.5 percent and 26.5 percent for Germany and the US respectively, means that serious inflation is almost inevitable in some key regions. The effects of covid are going to stretch some way into the future.”

Source: Interact Analysis