Interact Analysis Report: COVID-Driven Collapse in Geared Motor Market in 2020

COVID-driven collapse in geared motor market in 2020, but manufacturers need to prepare for return to strong growth from 2021 onwards (Image source: Interact Analysis)

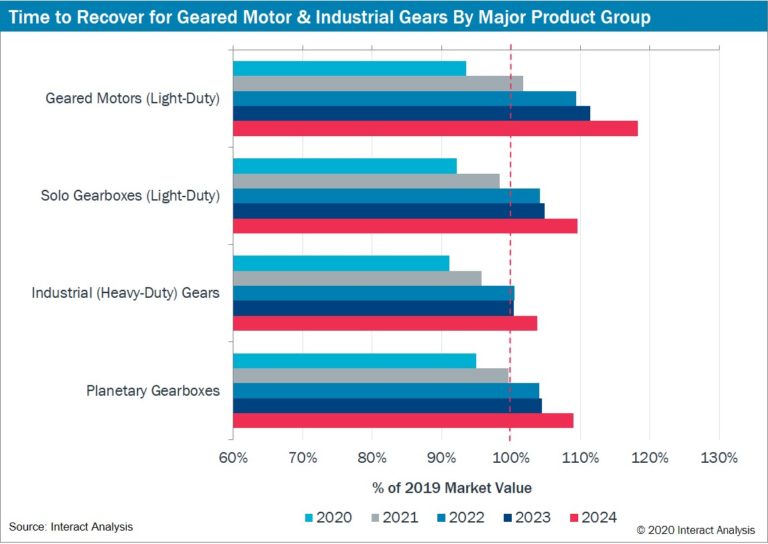

The 7%+ reduction in the geared motors and gearbox market for 2020 means short-term difficulties for manufacturers. However, all the indicators point to a period of sustained recovery and growth through 2021 and 2022, with slower growth up to 2024. The need for more automated and flexible equipment in a post-COVID industrial landscape is a major driver of this demand.

Growth will vary from region to region. Of the top ten markets for geared motors and industrial gears, China and India are predicted to head the growth table. Germany, surprisingly, given that she coped relatively well with the pandemic, will be the slowest to recover, owing to the sector’s reliance on the severely depleted export market.

Geared motors used in the transportation sector will, unsurprisingly, given how aerospace and automotive have suffered during the pandemic, be among the slowest industries to recover. Whereas products used in the logistics sector are forecast to see booming sales as rapidly increasing e-commerce and automation in the sector creates an ever-increasing demand for conveyors and packaging machinery – two of the largest markets gearboxes.

Of the different geared products – geared motors, heavy duty gearboxes, solo and planetary gearboxes; geared motors will see the fastest recovery, especially as end-users increasingly see the benefit of purchasing a packaged solution from a single vendor. Industrial heavy-duty gearboxes will continue to be the second largest gearbox market, but forecast growth will be negligible, seeing a below average CAGR of only 0.9% up to 2024. The market performance of these products is tied directly to the performance of industries such as metals and mining, which have seen a more severe COVID-induced dip in output and hence will take longer to recover.

Tim Dawson, Lead Analyst at Interact Analysis says: “Generally speaking, lighter-duty geared motor and solo gearbox products will recover more quickly than heavier-duty products. These solutions tend to be used more extensively in machinery sectors and end-user industries that have been less impacted by the pandemic. Some industries, such as warehousing and logistics have been positively stimulated by the virus, and are increasing investment in automated machinery incorporating geared equipment in response to high e-commerce demand, and the need to reduce the human workforce to enforce social distancing; this last factor being a significant driver of growth we would never even have conceived of 6 months ago. Such is the changing world we live in.”

About the report

This is the first report Interact Analysis has published on the geared motors and industrial (heavy-duty) gears market. The research was conducted during the period April to September 2020. During this timeframe considerable work was carried out to generate the most extensive set of data produced on the market to date. The lead analyst, Tim Dawson, has published numerous reports on this and related automation component and manufacturing areas over the last 20 years. The report is designed to inform planners and strategists engaged in the market for geared motors and industrial gearboxes used in both light-duty and heavy-duty applications. It provides a clear perspective on the prospects for these different sectors by country, industry and torque. Over 35 different interviews were conducted, and almost all medium-to-large geared motor and industrial gearbox companies participated in the research.

This report is unique in terms of depth and granularity, modelling growth at the tertiary level (by country and by industrial sector) with data collected through detailed primary research and analysis.

Source: Interact Analysis