Initial Public Offering of Dresser-Rand with $21,00 per Share

Dresser-Rand Group announced that it has priced its initial public offering of 27,000,000 shares of common stock at $21.00 per share. All of the shares are being offered by Dresser-Rand Group Inc.

The common stock will begin trading today, Friday, August 5, 2005, on the New York Stock Exchange under the symbol "DRC."

Morgan Stanley & Co. Incorporated and Citigroup Global Markets Inc. are serving as joint book-running managers of the offering. UBS Securities LLC is co-lead manager of the offering, and Bear, Stearns & Co. Inc., Goldman, Sachs & Co., Lehman Brothers Inc., Natexis Bleichroeder Inc., Simmons & Company International and Howard Weil Incorporated are co-managers of the offering. Dresser-Rand Group Inc. has granted the underwriters an option to purchase up to an additional 4,050,000 shares at the public offering price to cover over-allotments, if any.

The public offering is being made by means of a prospectus, copies of which may be obtained from Morgan Stanley, Prospectus Department, 1585 Broadway, New York, New York 10036 (tel. 212-761-6775) or Citigroup Global Markets Inc., Brooklyn Army Terminal, 140 58th Street, 8th Floor, Brooklyn, New York 11220 (tel. 718-765-6732).

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

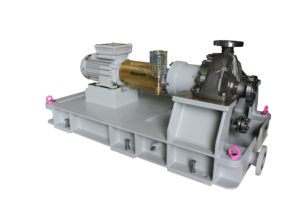

Dresser-Rand Group Inc. (NYSE: DRC) is among the largest global suppliers of rotating equipment solutions to the worldwide oil, gas, petrochemical and process industries. Facilities include a network of 24 service and support centers covering 105 countries, and manufacturing facilities in the United States, France, Germany, Norway, India, and Brazil.

Source: Siemens Aktiengesellschaft