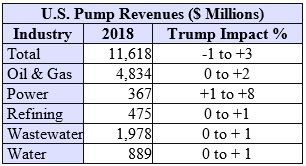

Impact of the Trump Administration on the U.S. Pump Markets

The market for industrial pumps in the U.S. is likely to be greater over the next few years with Trump as president than it would have been had Clinton been elected. In the weeks since the election, the stock markets are up and corporations are more optimistic about the near-term business outlook. The longer-term outlook is less certain as is the impact on world markets.

McIlvaine Company

The impact on the U.S. power industry will be positive with pump sales in 2018 rising as much as 8 percent due to Trump policies. Oil and gas will also be positively affected. The Keystone pipeline project will very likely now be built and other gas and oil projects will move through the regulatory maze more easily. The promised infrastructure program could boost pump sales to municipal water and wastewater plants.

Trump has vowed to bring back the coal industry, allow oil and gas development on federal lands, “cancel” the international Paris climate accord, scrap Obama’s Clean Power Plan and eliminate tax incentives for wind and solar power generation. He plans to slash the budget for the Environmental Protection Agency and a new Supreme Court justice is likely to favor limits on EPA’s authority. The Department of Energy’s budget is also expected to be cut, along with a corresponding decline in funding for clean energy research and development.

The impact on the power market will be favorable for two reasons:

- More gas turbine plants will be built and fewer solar and wind generators

- No new coal-fired power plants will be built but life extension programs will require significant numbers of valves

One trillion dollars would be allocated to an infrastructure program which would triple funding for state revolving loan fund programs to help states and local governments upgrade municipal water and wastewater plants. These plants have already allocated $75 billion/yr. over the next eight years for capital improvements. Federal funding for water utilities has fallen to $4.3 billion in 2014 from $16 billion in 1976. This has passed the burden onto states, municipalities and ultimately ratepayers. The new source of federal funding will result in larger capital expenditures of as much as $10 billion/yr.

Source: The McIlvaine Company