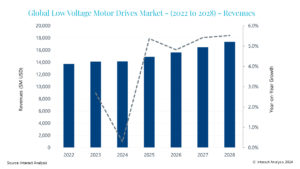

Global Manufacturing Output Set to Grow by a Mere 0.3% in 2024

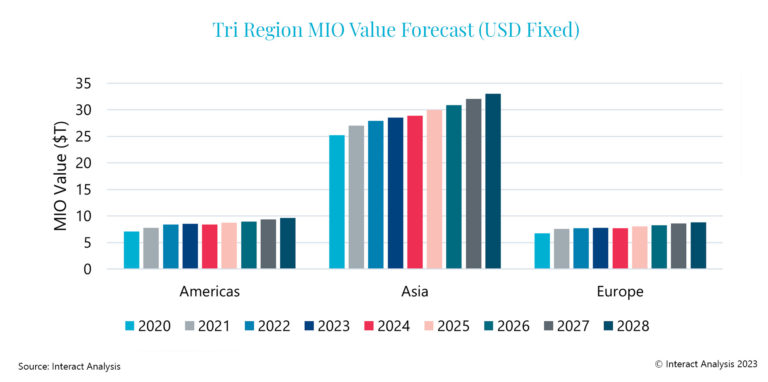

2024 is set to be a tough year for all regions in terms of manufacturing output growth. (Image source: Interact Analysis)

Europe in particular is feeling the pinch, while the Americas region fared well during the first half of 2023. Due to the semiconductor slump, manufacturing output in the Asia Pacific region is declining – the region accounts for almost 90% of semiconductor and components production.

Between 2023 and 2028, machinery production (as a sub-sector of manufacturing) is expected to grow faster than the manufacturing sector overall. In the Americas, machinery production will grow at a CAGR of 3.8% compared with just 2.4% for manufacturing production. In Asia, the sectors will grow at 3.9% and 2.9% respectively and in Europe 3.6% and 2.4%. In 2024 growth will be negative for machinery production, before returning to positive figures in 2025 and maintaining sustained growth out to 2028.

Taking a look at the manufacturing outlook by region, Europe is suffering the most from economic pressures. Despite this, the automotive sector seems to be performing well, particularly in Germany and France. Italy’s production output is set to grow by 2% in 2023, almost solely due to the automotive, transportation, and rubber & plastic sectors. The UK has performed better than expected, with output expected to have grown by 0.2% in 2023, contrary to the negative growth forecast by Interact Analysis in the previous edition of its report. In the US, growth is highly dependent on the reaction of the Federal Reserve. If interest rates drop too slowly in this region, 2024 will be bleak, but if they are increased too quickly inflation will skyrocket, leading to a period of economic stagflation. The semiconductor segment in the US is performing significantly better than other countries, particularly Taiwan and South Korea (which are set to see the sector shrink by over 20% in 2023). However, the US is expected to be the epicenter of the next global manufacturing recession, expected in 2024.

China’s economy is being driven by stimulus policies, which seem to be having a positive effect on the country’s manufacturing growth. The economy is expected to have gained some momentum in the second half of 2023 compared with a sluggish first half of the year. The full effect of government policies on the economy still remains to be seen, despite some positive signs in August of this year. Overall, Interact Analysis has revised China’s manufacturing output forecast down by 0.2 percentage points to 3.2% for 2023. However, forecasted growth for the region in 2024 has been revised up from 2.9% to 3%, with predicted CAGR between 2022 and 2027 sitting at around 3.2%.

Adrian Lloyd, CEO at Interact Analysis, comments, “The global manufacturing economy is finally starting to see some evidence of stability. While 2024 looks set to be a bleak period for all economies, it’s encouraging that China and the US in particular have enjoyed growth in some industries this year. The automotive sector appears to be performing well, even in Europe which is still riding out the storm. Following a tough 2024, we expect to see a significant uptick in the global economy, resulting in a period of sustained growth out to 2028 for all corners of the globe.”

Source: Golden Brain