Fluid Treatment and Control Market is $381 Billion/yr

There are a number of companies pursuing markets which treat, move and control liquids and gases. The total annual worldwide sales in this segment are over $380 billion.

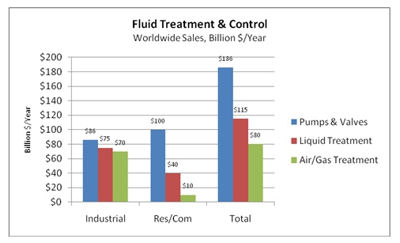

Fluid Treatment & Control - Worldwide Sales, Billions $/Year

This is the conclusion reached in Fluid Treatment and Control: World Markets, an online continually updated service of the McIlvaine Company.

Pumps and valves include actuators but not instrumentation which is included with the purification equipment under liquid treatment. Service and repair parts are included.

The liquid treatment category includes the chemical and physical processes utilized to purify or alter the liquids to meet environmental or process goals. Liquids include water, process fluids and petroleum products.

The air/gas treatment segment includes stack gases, indoor air, compressed air and specialized air applications such as hospital and electronic devices.

The industrial segment includes military and utility as well as remediation. The residential/consumer/commercial segment includes point-of-use and point-of-entry and includes special applications such as swimming pools and refrigerator filters.

The definition is limited to the products and services as furnished by hardware and consumables suppliers such as those listed below. It does not include revenues of big consulting firms such as Bechtel and AECOM. Nor does it include construction and turn-key revenues except where they are typically included. Power plant stack gas treatment is one example where most contracts are for complete systems. This definition allows one to aggregate the revenues of the suppliers in order to determine the present market. It also provides a means for determining market share.

Thousands of companies participate in this market. The top 30 companies account for more than 15 percent of global sales.

Leaders include ITT, Flowserve and GE. The merger of Ecolab and Nalco has created a top five player. The acquisition of a clean technology segment of Norit by Pentair has created a top ten player.

The growth rate in this sector will be well in excess of GDP due to the following facts:

- The rural migration of substantial percentages of the world population to urban areas

- The demand for cleaner water and air

- The high existing levels of pollution

- Industrial needs for pure fluids for nanotechnology, biofuels and other new technologies

- The substantial increase in seawater desalination

- Continued growth in cleaner coal-fired power

Some segments will experience double-digit growth. They include:

- Electrodeionization for ultrapure water but also for seawater and fuels

- Improved cross-flow membranes

- Reverse osmosis desalination

- Energy recovery pumps for reverse osmosis

- Lubrication treatment for wind turbines

- Mobile filtration in Asia

- Membrane bioreactors

- Byproducts from power plant pollution control including ammonium sulfate, higher grade gypsum and hydrochloric acid

- Sorbents for air pollution control

- Membrane bags for air pollution control

- Swimming pool purification products in Asia

- Residential point-of-entry water purification in developing countries

- Water treatment for unconventional fuels such as shale gas and oil sands

Source: The McIlvaine Company