Analyzing the Low Voltage AC Motor Market Performance in 2023 and Beyond

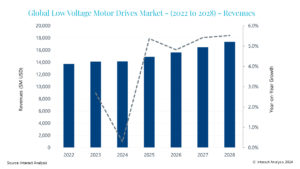

A brief history and forecast for low voltage AC motor market revenues in industrial and commercial applications (Image source: Interact Analysis)

As we approach 2024, the market is poised to continue this deceleration, moving further away from the double-digit growth experienced during 2021 and 2022. The projected contraction of -0.7% underscores a market which is nearing the trough of its natural cycle.

Understanding the low voltage AC motor market’s performance in 2023

Over the past three years, the low voltage AC motor market has experienced significant revenue growth, with year-over-year growth rates reaching 16.4% in 2022. While the rate of revenue growth decelerated substantially in 2023, it is important to note that much of this deceleration is due to lack of price rises. When viewed through the lens of unit shipments, the slowdown is less dramatic. 2023 is expected to post year-over-year growth of 2.9%, down from 4.0% in the previous year. While the decline is modest, the timing and nature of the decline is indicative of what the market can expect for the near future.

Between 2020 and 2022, demand for motors significantly outstripped the production capabilities of many suppliers. As a result, backlogs increased and the benefits from a post COVID-19 surge in demand were spread across 2021, 2022, and into 2023. The market for low voltage AC motors benefited from this through the first half of 2023, however, this quickly changed during the latter half of the year.

New orders for motors saw a significant downturn beginning in June 2023, as interest rates continued to climb and projects became delayed amid economic uncertainty. This resulted in backlogs largely drying up for motor suppliers and many vendors experiencing a contraction during the last 6 months of the year. Consequently, 2023 went from being a continuation of above average growth, to a mediocre year.

At the start of 2023, evidence of the coming slowdown was already beginning to show. Within the US market, the Federal Reserve produces a series which tracks year-over-year percentage changes for industrial machinery production on a monthly basis. As early as February 2023, the value of industrial machinery production had begun to contract. This is indicative of what we’ve heard in interviews within other regions as well. When you consider that approximately 70% of motor revenues are generated through sales to machinery and equipment OEMS, this contraction has a significant impact the demand for motors.

2024 and Beyond

This downward momentum is expected to continue into 2024, as the market enters the low point in its cycle, and we are expecting the market to contract by -0.7% this year. While performance varies across regions – with some still maintaining growth during the year – nearly all regions are performing below their 2023 levels. While underlying manufacturing industry performance is the core driver of this decline, we are forecasting a slight decrease in average selling price which is further exacerbating the decline in revenues.

Prices remained steady in 2023, following two years of rapid increases. However, with a year of lower demand expected for 2024, we anticipate large customers will have stronger negotiating power with their suppliers. This is likely to manifest as downward pressure on the average sale price for the market.

With a down year expected in 2024, the question becomes: what is the expectation for 2025? Our forecast shows a return to growth in 2025, as underlying industrial machinery production increases and the price growth of motors returns to the expected 2-3% per year. Globally, over the 16 years of data that Interact Analysis has analyzed, the value of machinery production has never had back-to-back years of contraction. We do not expect 2025 to be any different. We are expecting growth to return in 2025 and remain through to the end of our forecast, as the low voltage AC motor market enters its upswing once again.

Final Thoughts

With the market cooling after a few years of exceptionally strong growth, many vendors are looking for key growth areas. Sectors where we continue to see growth above the market average are those heavily tied to government spending. Following the pandemic, many of the largest economies approved legislation aimed at improving infrastructure as a means to stimulate the economy. This had the effect of buoying the motor market during the manufacturing downturn. Sectors like power generation and water/wastewater, for example, are posting above average growth rates when compared with the broader market. This will continue through our forecast as the allocated funds are worked through.

Source: Interact Analysis