Weir Acquires Pompe Gabbioneta SpA

The Weir Group PLC announced the signing of an agreement to purchase 100% of the issued share capital of Pompe Gabbioneta SpA, a specialist petrochemical pump business located in Milan, Italy. The consideration for the purchase will be €100 million payable in cash on completion.

The transaction is expected to complete on or before 30 September 2005. The acquisition is expected to be immediately earnings enhancing following completion.

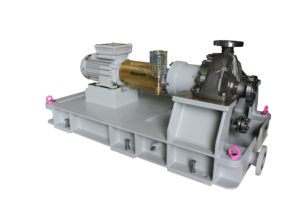

Gabbioneta manufactures speciality pumps primarily for the downstream end of the oil and gas market. The company has a wide range of customers including oil majors and leading engineering contractors and is ranked number three in the European, Middle East and African petrochemical pump market where it has a significant installed base.

For the year to 31 December 2004, Gabbioneta reported sales of €44.8m, earnings before interest, tax and amortisation (EBITA) of €6.7m and profit before tax (PBT) of €3.1m under Italian GAAP. Under IFRS rules amortisation of €2.5m will not be charged going forward. As at 31 December 2004 gross assets were €48.9m. Unaudited management accounts for the first six months of 2005 indicate that both revenues and operating profits are ahead of the prior year.

Gabbioneta, which operates from two facilities in Milan, employs 240 people. The business was established in 1897 and was most recently owned by private equity funds led by Aksia Group.

The acquisition is in line with Weir’s strategic objective to grow the Clear Liquid business in higher margin, high growth specialist markets.

The Board of Weir believes that the acquisition of Gabbioneta offers many benefits and opportunities which include:

- The acquisition of a well established business with a considerable installed base enjoying a high level of customer loyalty and complementary geographic footprint.

- The opportunity to create a global centre of excellence in oil process pumps.

- A strengthening of Weir’s relationship with many of the world’s major oil producers through increased sales volumes and broader product offerings.

- The opportunity to extend Gabbioneta’s markets in the USA and Asia, using the Weir name and geographic footprint, and Gabbioneta’s existing installed base.

- The opportunity to obtain further benefits from Weir’s recent investments in purchasing and manufacturing technologies and systems.

Commenting on the acquisition, Mark Selway, Chief Executive said, “This is a significant development for the Weir Group. Our strategy is focused on consolidating our position in the specialist pump market and building a portfolio of high quality high margin businesses. The acquisition of Gabbioneta achieves both.

“By integrating Gabbioneta into our Clear Liquid Division we will enhance our portfolio of oil processing products. Furthermore, the creation of an enlarged client base will provide opportunities to expand our product offering and services into the oil and gas industry.

“We very much look forward to working with the existing Gabbioneta management and staff, including chief executive Roberto Zecchi, to grow and develop the business into a leading global player in the petrochemical pump market.”

Source: The Weir Group PLC