The Global Dry Vacuum Pumps Market Size Is Expected to Reach US$ 2,700 Million in 2023

During the forecast period 2023 to 2033, the market indicates growth at ~7% CAGR. This is expected to result in a market size of US$ 5,296.2 million by 2033.

The global dry vacuum pump market is driven by the growing demand for vacuum pumps in across a wide range of sectors. These include semiconductor manufacturing, pharmaceuticals, food and beverage, chemical processing, and oil and gas. These sectors require reliable and efficient vacuum pumps for applications like material handling, packaging, coating, and drying processes.

Environmental regulations regarding emissions and energy efficiency are driving the adoption of dry vacuum pumps. Dry vacuum pumps offer advantages over traditional oil-sealed pumps as they eliminate the use of oil.

Methods used in dry vacuum pumps reduce the risk of oil contamination and eliminate the need for oil disposal. This makes them more environmentally friendly and compliant with regulations.

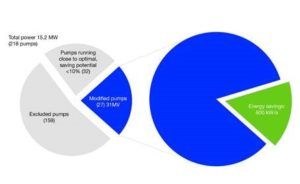

Energy efficiency is a significant driver in the global dry vacuum pumps industry. These pumps are known for their high energy efficiency compared to oil-sealed pumps. They consume less energy during operation. Users prefer dry vacuum pumps due to their reduced energy costs and smaller carbon footprint. As companies strive to optimize their energy consumption and reduce operating costs, the demand for energy-efficient dry vacuum pumps is increasing. Technological advancements are driving innovation in the dry vacuum pumps industry. Manufacturers are constantly developing new designs and materials to improve the performance, reliability, and durability of dry vacuum pumps.

Consumers want devices that are advanced but also easy to operate. Some innovations include the use of advanced control systems, improved sealing mechanisms, and innovative materials that enhance pump efficiency and reduce maintenance requirements. The semiconductor sector is a significant driver for the global dry vacuum pump market. Vacuum pumps are extensively used in semiconductor manufacturing processes, such as wafer etching, thin film deposition, and ion implantation. Advancements in the semiconductors sector due to 5G, artificial intelligence (AI), and Internet of Things (IoT), is further fueling the demand for dry vacuum pumps.

What Are the Recent Trends Influencing the Market?

The industrial internet of things (IIoT) is a technological innovation that helps in analyzing objects and their status in digital data formats to enable easy control over operations. In modern electromechanical devices, product failures occur with unexpectedly small variables due to the miniaturization of processes. Managing the condition of each part is an effective way to avoid unexpected failures. Industrial Internet of Things (IIoT) technology can continuously monitor the performance of parts that affect process outcomes. This makes it possible to save time in scheduled equipment maintenance without compromising production efficiency.

The only parts of an air vacuum pump that require oil are the bearings and the gearbox, which are essential for its speed control. Recent advancements in nanotechnology and lubricant materials are increasing the maintenance overhaul of dry vacuum pumps, making them more production-efficient.

Another trend in global dry vacuum pumps m market is the energy efficiency. Global dry vacuum pumps provide energy efficient solutions and offer various advantages. It includes great performance, low power consumption and less environmental impact as compared to traditional pumps. The demand for global dry vacuum pumps is increasing in the market.

Which Product Type is Likely to Register Lucrative Revenues?

Safety Against Contamination Driving Popularity of Dry Screw Vacuum Pumps

By product type, the dry screw vacuum pump segment is expected to account for more than half of the market share over the forecast period. The segment is expected to reach revenues worth US$ 2,820.8 million by 2033.

Unlike oil sealed vacuum pumps, dry screw vacuum pumps operate without the need for oil lubrication. This eliminates the risk of oil contamination in the pumped gases or the environment.

Oil-free operation is crucial in applications where oil contamination can cause product quality issues, and process and environmental concerns.

Which End-use Segment has Prominent Demand for Dry Vacuum Pumps?

Pharmaceutical Segment Dominates the Global Dry Vacuum Pumps Market

By end-use, pharmaceutical segment is expected to hold more than one fifth of the market value over the forecast period. The segment is expected to reach a value of US$ 1,171.7 million by 2033.

Dry vacuum pumps are designed to handle a wide range of chemical compounds without the risk of contamination and chemical reactions. This is particularly important in pharmaceutical applications where multiple chemicals and solvents are used during production. Dry vacuum pumps can handle aggressive chemical and organic solvents without the need for additional precautions.

Competitive Landscape

Manufacturers have been heavily focused on acquisitions to improve the dry vacuum pumps industry product range. Companies are investing heavily to increase their output in the local marketplace and capitalize on growth potential. Manufacturers are also broadening their reach to improve their sales and customer service through a robust distribution network. They are working on various channels of distribution, such as via the internet, to increase their market share in both regional and worldwide markets. Several big firms are concentrating on acquiring little businesses, but small- and medium-sized businesses must make large expenditures in research & development operations to develop new products and expand their global footprint.

For instance, in September 2023, Flowserve Corporation has announced the launching of its SIHI Turbo UltraPLUS dry-running vacuum pumps. The recently introduced machine is intended to cut batch process cycle times by up to 50% or more.

In February 2020, Edwards introduces the recently launched nXRi highly efficient small dry pump, which has a reduced input power and requires no maintenance, resulting in actual performance increases and cost savings across a wide variety of applications.

Source: Future Market Insights