Sulzer Delivers Strong Results in 2023 with Focus on Structurally Growing Markets

Image source: Sulzer Ltd.

Operational profit (EBITA) increased by 25.3% thanks to solid sales growth and effective cost management. Given the significantly increased operational profitability and stringent management of employed capital, these reported figures are at a 10 year high. Sulzer capitalized on good market momentum, focused sales efforts and the first results of our Sulzer Excellence initiatives.

Divisional performance

All three divisions recorded double digit sales growth, while increasing operational profitability and cash flow significantly. Effective price management, cost discipline and operational excellence in manufacturing laid the basis for these strong results.

Flow Equipment achieved an operational profit of CHF 108 million representing an operational profitability of 8.0% in 2023 – significantly up from 6.6% in 2022 and the best result in 10 years. Sales increased by 10.9% to CHF 1’354 million, with all business units growing. The division recorded large individual orders in the first half of the year, contributing to the increase in order intake to CHF 1’467 million, up by 11.2% compared to last year.

Services delivered its strongest growth in ten years, thanks to robust demand across all regions. Sales increased by 14.5% to CHF 1’155 million. Operational profit amounted to CHF 171 million. Operational profitability increased by 60 basis points to 14.8%. Order intake increased by 19.8% to CHF 1’271 million.

Chemtech benefited from large orders in emerging technologies. The division secured large orders in the bioplastics, biofuels and process technology businesses during the first half of the year. Sales increased by 15.5% to CHF 773 million. Operational profitability increased by 150 basis points to 12.3%, amounting to CHF 95 million. Order intake increased to CHF 842 million.

Strategy «Sulzer 2028»

Sulzer subjected its strategy to a comprehensive review in 2023. At core, Sulzer is active in the right markets. However, Sulzer’s products, services and technologies need to be positioned more strongly towards creating customer value. Further, Sulzer has significant potential to increase its value creation and operational profitability by adjusting the way it operates.

Over the last year, Sulzer has focused on market and financial performance to lay the foundation for the implementation of its revised strategy. Over 100 initiatives have been initiated to address the two pillars of «Sulzer 2028»: Organic Growth and Sulzer Excellence along the entire value chain. Sulzer’s strong 2023 results in terms of growth and profitability are testament to the successful start of the strategy implementation.

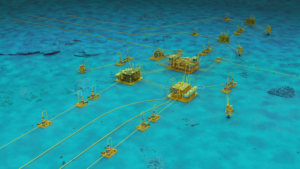

Sulzer increases its focus on essential markets with attractive structural growth of 3% to 5%: Energy, Natural Resources and the Process Industries. These markets are of immense importance for the well-being and prosperity of a growing world population. Sulzer supports clients in these markets with equipment and technologies that improve the efficiency, cost effectiveness and quality of their operations. At the same time, these markets are subject to a profound long-term transformation: towards a low-carbon energy system, towards long-term viable use of natural resources and towards a process industry that offers essential base chemicals, while reducing its ecological footprint. Sulzer is well positioned to support its customers in this transition to a more sustainable economy and society.

With the revised strategy, Sulzer moves from supplying fragmented products to integrated equipment and technology packages to address customer challenges in these transforming markets. As «One Sulzer», all three divisions serve the same markets and customers with complementing technologies and capitalize on the attractive growth potential this joint approach offers.

In order to profitably succeed with these growth aspirations, Sulzer addresses the operational need for action with the second pillar of its revised strategy: Sulzer Excellence along the entire value chain, from Innovation to After Market Services. This multi-year effort will reduce complexity and increase both efficiency and speed of processes. The related initiatives are paving the way for Sulzer to become a top industrial company with (cost) effective, high-quality processes and entrepreneurial spirit.

Dr. Suzanne Thoma, Sulzer’s Executive Chairwoman, concludes: «Sulzer at core is a successful and valuable company. Our 2023 results are driven by good customer momentum in structurally growing markets and reflect the first effects of our strategic initiatives. Our three divisions are connected through our value chain, technologies and key capabilities, and show attractive prospects for development. We have a clear strategy moving forward, Sulzer 2028, through which we are building on this very solid foundation, aiming for further organic growth and Sulzer Excellence along the value chain. Together, as one company, we serve essential industries to contribute to a prosperous global economy and sustainable society – and truly create value for all stakeholders.»

Outlook 2024

Despite a global environment characterized by uncertainty, Sulzer has delivered strong financial results across all its divisions and is well-positioned for growth in the coming year and beyond. For 2024, Sulzer expects year-on-year organic order intake growth of 2 to 5%. The first half of the year is expected to see a slow development of order intake compared to the very strong first half of 2023, with performance picking up in the second half of the year – this expectation reflects the nature of the project business in Sulzer’s markets. Further, Sulzer expects organic sales growth of 6 to 9% and operational profitability to continue its upwards trajectory to around 12% of sales.

Proposals of the Board of Directors at the Annual General Meeting

The Board of Directors will propose an increase of the ordinary dividend to CHF 3.75 per share at the Annual General Meeting on April 16, 2024 (AGM), compared to an ordinary dividend of CHF 3.50 per share in 2023. This reflects the resilience of our company, the value creation for our shareholders and our confidence in Sulzer’s future performance.

Furthermore, the Board of Directors proposes the re-election of all current members of the Board of Directors (including the Board Chair) and the Remuneration Committee.

Source: Sulzer Ltd.