Strong FY2022: Results with All-Time High Profitability

The GF Annual Media Conference was held in Zurich for the first time since the end of the COVID-19 pandemic. (Image source: Georg Fischer AG)

Organically, sales grew strongly in the US (+21%) and Europe (+11%) and remained stable in China, despite significant headwinds related to the pandemic and its adverse effects on the country’s economy.

The strategic thrust to focus on resilient and sustainable end markets with innovative solutions, as well as the initiatives to further develop GF's Winning Culture, paid off and enabled GF to withstand persisting macroeconomic challenges, such as the impact of the war in Ukraine, COVID-19 lockdowns across China and high inflation rates.

Group results

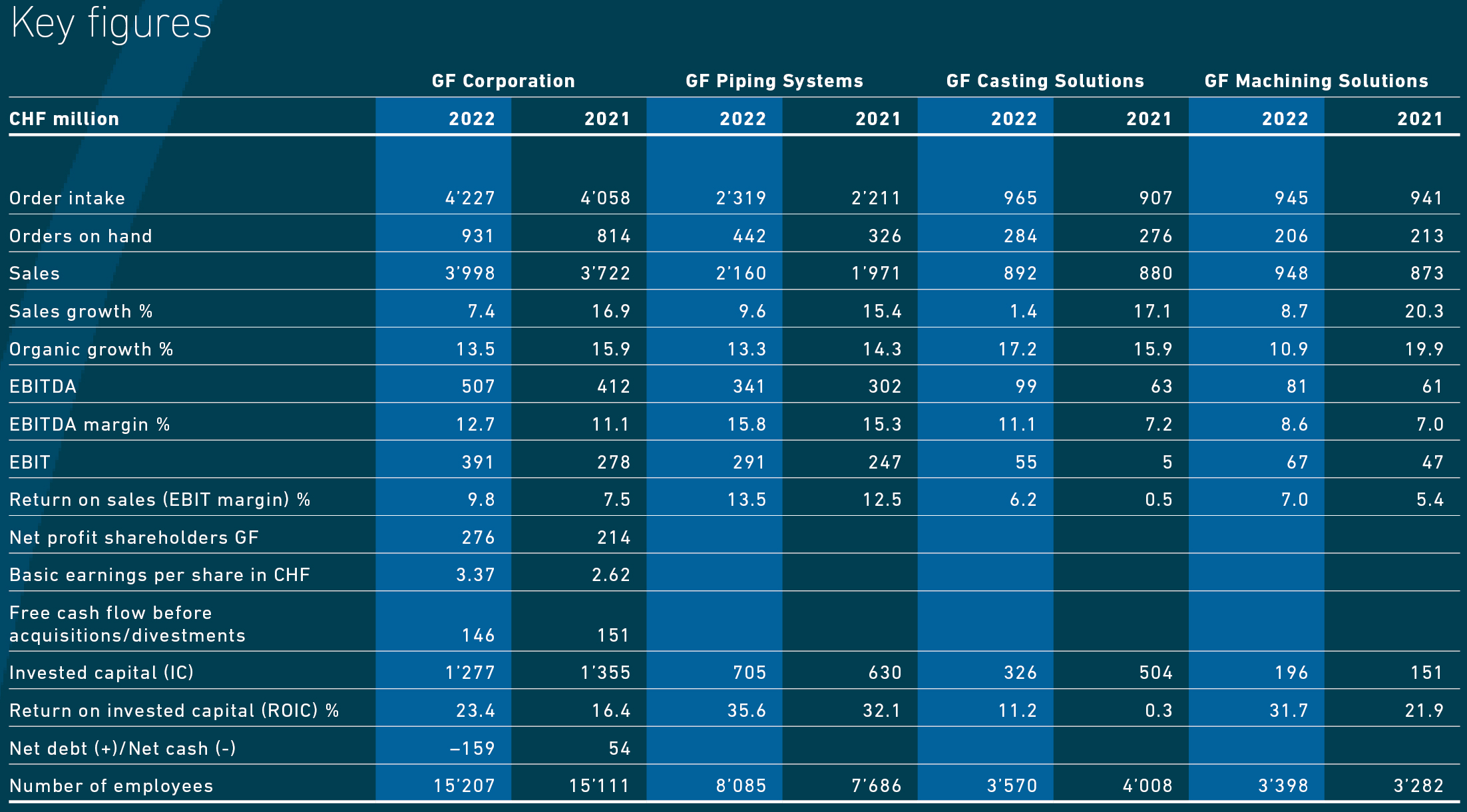

Order intake reached CHF 4.2 billion (+4.2%, +10.3% organically). Sales amounted to CHF 4.0 billion, an increase of 7.4% (13.5% organically) compared with 2021, supported by price adjustments and strong US and European markets. Overall, sales were impacted by negative currency effects of approximately CHF 142 million.

The operating result (EBIT) rose 41% to CHF 391 million. The EBIT margin reached the highest level ever recorded at GF with 9.8%, already well within the target range set in the Strategy 2025. In 2021, these figures were CHF 278 million and 7.5%, respectively.

The return on invested capital (ROIC) reached an excellent 23.4% (2021: 16.4%), exceeding the ambitious average target range in the Strategy 2025 (20% to 22%). GF Piping Systems and GF Machining Solutions achieved remarkable ROIC levels of 35.6% (2021: 32.1%) and 31.7% (2021: 21.9%), while GF Casting Solutions' ROIC was 11.2% (2021: 0.3%).

At the end of 2022, 15’207 employees worked for GF, compared with 15'111 employees at year-end 2021 (+0.6%).

Free cash flow reached a high level of CHF 201 million (2021: CHF 110 million). Free cash flow before acquisitions/divestments amounted to CHF 146 million, compared with CHF 151 million the year before.

Net profit attributable to shareholders of GF amounted to CHF 276 million (2021: CHF 214 million), reflecting an increase of 29%.

In April 2022, GF successfully divested its 50% stake in the joint venture in Mills River (US) between GF Casting Solutions and Linamar Corp., Guelph (Ontario, Canada), while GF Machining Solutions acquired 100% of Italy-based Vam Control S.r.l. in July 2022, to further strengthen its service and engineering offering in Europe. As a consequence of the war in Ukraine, GF ended its trading operations in Russia in the first quarter of 2022 and closed its representative office in Moscow during the course of the year.

On 28 April 2022, GF shares were split at a ratio of 1:20 to allow for higher trading volumes. Earnings per share were up to CHF 3.37 compared with CHF 2.62 in 2021, adjusted for the share split. At the upcoming Annual Shareholders' Meeting, the Board of Directors will propose a dividend per share of CHF 1.30 compared with CHF 1.00 in the previous year (adjusted for the share split).

GF Piping Systems

Sales for the first time surpassed the CHF 2 billion mark at CHF 2'160 million, representing a growth of 9.6% and an organic growth of 13.3% compared with the previous year (CHF 1'971 million). EBIT stood at CHF 291 million, 18% above the previous year (CHF 247 million), resulting in an EBIT margin of 13.5%, compared with 12.5% in 2021.

Segments such as microelectronics, process automation and water treatment continued to drive the performance of GF Piping Systems, which is successfully present in growth markets that address important sustainability megatrends across the world.

The division recorded a strong organic growth in the Americas (+21%) and a solid organic growth in Europe (+5%), thanks to its strong industrial presence in these markets. This helped mitigate the effects of the COVID-19 lockdowns in China and a softer Building Technology market in China and Europe. Input price increases were successfully passed on to the market, contributing to growth.

GF Casting Solutions

GF Casting Solutions reached sales of CHF 892 million (2021: CHF 880 million), an increase of 1.4% (organically +17.2%). The strong organic growth is the result of favorable demand for components for e-vehicles, an increase of supplies for industrial applications, higher metal prices and a rebound of the aerospace market. Growth was negatively affected by the divestment of the Joint Venture in the US and currency effects.

Sales of components for e-vehicles increased by 27% to CHF 112 million. Lifetime order intake for e-vehicle components amounted to CHF 566 million (2021: CHF 433 million) with a share of 57% of the total light-metal orders. EBIT came in at CHF 55 million (2021: CHF 5 million), considerably higher than in the previous year. The EBIT margin reached 6.2% (2021: 0.5%), supported by a good performance in the second half of the year.

In April 2022, the division sold its 50% stake in the light metal foundry in Mills River (US) to its joint venture partner. The division subsequently entered into a strategic partnership with Mexico-based Bocar Group, a light metal castings and assemblies solutions provider, to develop and invest in new technologies and services to support customers in North America, Europe and China on their way toward sustainable mobility. The new facility in Shenyang (China) has started the delivery of aluminum and magnesium components to the local customers.

GF Machining Solutions

GF Machining Solutions reached an order intake of CHF 945 million, representing an organic growth of 3%, thanks to robust end markets, such as medical and new mobility, but also due to a recovering aerospace industry. Sales increased by 8.7% (10.9% organically) to CHF 948 million (2021: CHF 873 million), thanks to a good market development in milling applications and strong sales in laser texturing and electrical discharging machining (EDM). Sales of solutions with automation also strongly increased and customer service remained a solid pillar of the division.

The APAC region and European markets were key drivers of the organic growth, and while the business in China was affected by the COVID-19-related lockdowns, sales remained at the previous year's level. Despite supply chain disruptions for components, EBIT of the division reached CHF 67 million (2021: CHF 47 million), leading to an EBIT margin of 7.0% (2021: 5.4%).

The division reinforced its position as an industrial technology leader with a high innovation rate. GF Machining Solutions is pursuing its strategy to strengthen customer experience and service offerings.

Strategy 2025 on track; sustainability deeply embedded in GF's business

GF's strategic focus on solutions addressing customers' sustainability needs is generating steady growth. At GF Piping Systems, these are, for example, solutions to minimize losses in cooling systems or water infrastructure. GF Casting Solutions focuses on components to reduce the weight of e-vehicles. Replacing chemical etching with laser texturing is another such example from GF Machining Solutions. The strong and well-balanced presence in Europe, Asia and the Americas is another key factor that strengthens the resilience of GF and enabled the company to grow substantially in 2022 despite strong headwinds.

GF is jointly reporting all financial and ESG key figures for the first time together in its 2022 Corporate Reports. In the year under review, GF reached an important milestone with its near-term greenhouse gases (GHG) emissions targets being validated by the SBTi (Science Based Targets Initiative). The company is steadily investing in its own processes and facilities to reduce CO2e emissions. In 2022, scope 1 and 2 emissions were reduced by 14% compared with 2021, well in line with the Sustainability Framework 2025.

GF is also pursuing a culture change to unleash the full potential of its most important asset, its people. The company strives to create and foster a diverse and inclusive work environment, where inspiration, collaboration and innovation empower employees to perform at their best and are key elements to attract and retain talent.

Proposed changes to the Board of Directors

GF has announced it will propose Michelle Wen and Monica de Virgiliis as new members of the Board of Directors at the next Annual Shareholders' Meeting on 19 April 2023. These experienced senior executives will further deepen the Board's expertise on key strategic topics, such as global purchasing and supply chains, as well as the energy and semiconductor fields. GF also announced that Jasmin Staiblin will not stand for re-election due to GF's 12 year-limit on Board tenure, while Riet Cadonau has decided not to stand for re-election for personal reasons. GF warmly thanks Jasmin Staiblin and Riet Cadonau for their excellent service over the years.

Outlook 2023

Geopolitical and macroeconomic uncertainties are persisting in 2023, and are thus further limiting visibility for the full year. However, GF expects its strong position in resilient market segments and its balanced global presence to partially offset possible recessions in various markets. GF is well positioned in growing segments, such as semiconductors and water treatment for GF Piping Systems. GF Casting Solutions is set to further benefit from the increasing demand of e-vehicle components and GF Machining Solutions has already started 2023 with a solid order book. GF expects a further recovery in previously subdued markets, such as aerospace or marine. Markets in China are also expected to stabilize and further grow after the COVID-19-induced slowdowns.

Barring any unforeseen circumstances, GF expects to continue growing with an operating profitability in the Strategy 2025 corridor (EBIT margin 9-11%).

Source: Georg Fischer AG