Shifting in the Air/Gas/Water/Fluid Market

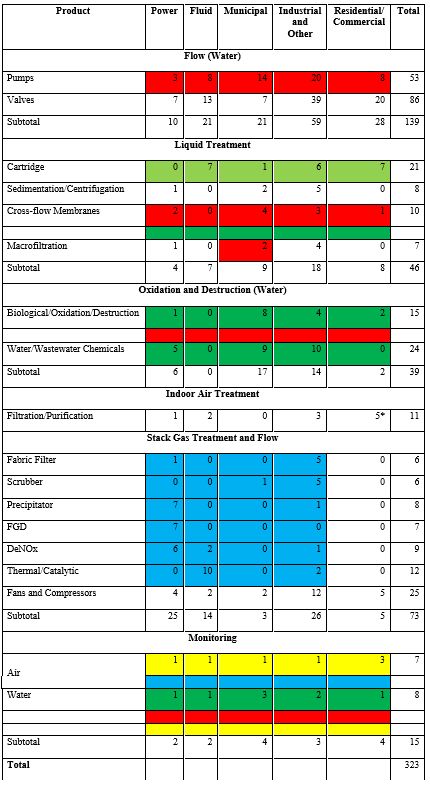

The Danaher acquisition of Pall, the acquisition of Howden by Colfax, and the Nalco acquisition by Ecolab are all product expansions in the air/gas/water/fluid treatment and control market. This was a $323 billion market in 2012 and is now well above $350 billion. This market is continually analyzed in McIlvaine’s Air/Gas/Water/Fluid Treatment and Control: World Market. Despite the acquisitions none of the companies commands a significant share of the total market.

Air/Gas/Water/Fluid Market ($ Billions) (Image: McIlvaine Company)

Danaher, Teledyne, Xylem and B&W are all in the air and water monitoring market. B&W and Teledyne are in the air segment. Danaher, Teledyne and Xylem are in the water monitoring segment. However, these three companies do not compete in most of the other segments. So despite the acquisitions, no company covers all the major segments.

With the acquisition of Pall, Danaher is now in five segments, Xylem is in four segments, B&W is in seven sub-segments but they are involved with stack gas. Teledyne is in just two of the segments. Danaher has now increased its market share to over one percent. The three others have shares below one percent.

Key Color Code

Green = Dahaher

Red = Xylem

Blue = B&W

Yellow = Teledyne

Source: The McIlvaine Company