Sea Change in the Pump and Valve Markets

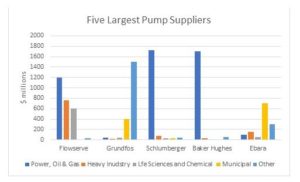

The total combined pump and valve market is over $200 billion per year. The performance needs include severe, critical, unique and general service. All except general can be considered high performance. The revenues in high performance applications are over $80 billion per year.

The sea change is taking place in all segments but is critical to the high performance products.

Here is the evolution which makes this sea change so important

- High performance products are sold by demonstrating lowest total cost of ownership (LTCO).

- The supplier must understand the customer’s needs in order to develop an LTCO product.

- Digital technology such as condition and performance monitoring provides evidence of LTCO.

- Purchasers have avoided new and better products previously due to challenges in determining LTCO.

- The supplier who can validate LTCO can now easily reach new markets and customers.

- Digital technology pinpoints product weaknesses and provides a guide for product improvement.

- With the expanded market the supplier can afford the R&D for product improvement.

- The supplier develops unique knowledge about the role his product can play in lowering customer TCO.

- This knowledge allows the supplier to become a solutions provider who with 24-7 access can help minimize TCO over the life of the plant.

The tsunami for those suppliers who don’t adapt includes usurpation of the LTCO role by the digital systems integrators. They can reduce the pump or valve supplier role to just delivery of specified hardware.

There is one major hurdle to catching the fair winds. While vast amounts of digital evidence is now available, the organization and access to it is at best 50% vast.

McIlvaine is working with the media as well as suppliers serving the pump and valve industry to assist them in organizing predicate and disputed evidence relative to valve and pump choices. .

This organization of knowledge can be considered an Industrial Internet of Wisdom (IIoW) which is integral to IIoT.

Source: The McIlvaine Company