Order Intake of CHF 1.56 Billion

In the first half of 2009, Sulzer received orders for CHF 1556.2 million. This was an adjusted decrease of 29.2% (nominally –31.3%) compared with the record level of last year’s first half. As projected, the dynamics in Sulzer’s key markets worsened and demand was clearly below the previous year’s level. For the full year, Sulzer expects a substantially lower order intake compared to the high level of 2008.

Order intake in the first six months of 2009 was clearly below the record level of last year’s first half. In the context of the global economic downturn, virtually all of Sulzer’s key markets declined. The oil and gas (upstream) as well as the hydrocarbon processing industries (oil and gas downstream) were particularly affected, whereas the power generation industry remained relatively robust. The pulp and paper market continued to be weak and activities in the automotive market were at a low level. The aviation industry remained relatively active. Negative currency effects continued, while acquisitions had a small positive effect. Geographically, all regions were affected by the deteriorated economic situation, although China and Brazil remained somewhat stronger by comparison. Sulzer does not expect a quick recovery in its key markets. As announced on June 24, 2009, the company is therefore implementing a global cost reduction program for all divisions in order to adapt its cost structure and capacities to the clearly lower market demand. While realigning to the new market realities, Sulzer remains focused on sustainable long-term value creation with innovative, customer-oriented solutions for performance-critical applications.

Order intake by division

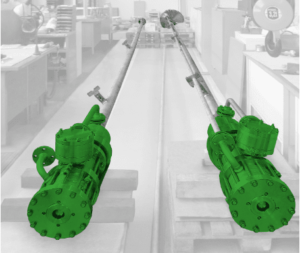

Orders received by Sulzer Pumps totaled CHF 884.5 million. This was an adjusted1 decrease of 24.2% (nominally –29.4%). The oil and gas as well as the hydrocarbon processing industries weakened notably, while the power generation market continued comparatively strong. Demand in the pulp and paper industry remained weak. Most regions were affected by the weak market conditions, particularly North America. The division maintained its strong market position despite the challenging conditions. The high order backlog ensured good capacity utilization. As the economic downturn is reducing demand for oil and oil derivatives, investment levels in the oil and gas as well as the hydrocarbon processing industries are expected to weaken further in the second half of 2009. Activities in the power generation market are projected to decline, as the number of large projects is likely to decrease. The pulp and paper industry is expected to remain weak. Order intake for the full year is projected to be notably below the exceptionally high prior year.

Sulzer Metco recorded an order intake of CHF 277.8 million. On an adjusted1 basis this was –25.8% compared to the previous year’s first half (nominally –27.6%). Demand weakened particularly in the automotive and other industrial markets, while the aviation and the power generation industries remained relatively stable. Geographically, orders in all regions were affected, particularly in Europe. Demand in the automotive and other industrial markets is expected to remain low. As a result of the decreasing passenger and cargo miles flown, activities in the aviation industry are likely to decrease in the second half of the year. The division’s innovative solutions experience high customer acceptance, confirming its strong market position. For the full year, order intake is projected to be clearly below 2008.

Sulzer Chemtech reported an order intake of CHF 244.9 million, which represented a decrease of 50.1% (adjusted1) respectively 47.5% (nominal) compared to the strong first half of 2008. The hydrocarbon processing industry weakened substantially in all regions due to the decline in the consumption of oil, chemicals and plastics. As customers were cautious with capital investments, demand for new equipment declined notably. The division maintained its strong market position with innovative solutions, increased service and a broad global footprint. A substantially lower order intake is expected for the full year compared to the high level of 2008.

Sulzer Turbo Services posted an order intake of CHF 143.6 million, an adjusted1 decrease of 13.3% (nominally –7.0%) compared to the previous year’s first half. The division benefited from comparably stable demand for its services. Activities in Europe and Southeast Asia declined, while in North America, the changed economic situation became noticeable only toward the end of the first half-year. The hydrocarbon processing industry and other industrial markets are expected to show further softening, whereas the power generation industry should remain comparatively stable with some ongoing encouraging project activities. The division expects order intake for the full year below the level of the previous year.

Outlook

While the long-term prospects for Sulzer’s performance-critical solutions remain positive, the company does not expect a quick recovery in its key markets. The oil and gas as well as the hydrocarbon processing industries are expected to show clearly lower activity compared to the levels of the year 2008. Also, in the power generation market, project activity is expected to decrease. The pulp and paper industry will remain at a low level and the general weakness in the automotive industry is expected to continue. The aviation market, which has been relatively stable so far, is likely to decline later this year. Geographically, all regions will continue to be affected by the economic downturn; however, activities in some emerging markets are likely to remain comparatively stronger. For the full year, Sulzer expects a substantially lower order intake compared to the high level of 2008. The cost reduction and capacity adjustment program will strengthen Sulzer’s ability to manage the challenges in a difficult economic environment. With its continuous focus on innovation leading to adapted and new products, services and solutions, Sulzer is well positioned for sustained success.

1 Adjusted for currency effects as well as acquisitions.