Large Replacement Market for Municipal Wastewater Combust, Flow and Treat Products

The market for combust, flow and treat (CFT) products for municipal wastewater treatment plants is growing faster than GDP and is larger than represented in many reports.

McIlvaine

Forecasts for purchases of each type of product by municipal wastewater plants is made possible by detailed analysis of the treatment flow rates and each specific variable impacting the market for a product.

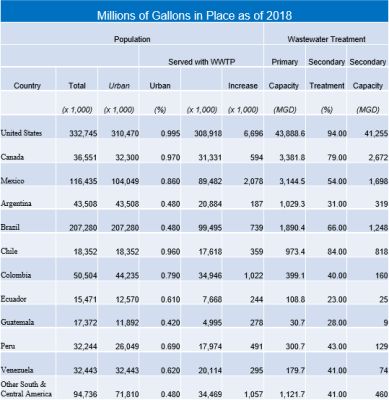

The starting point to determine the market for CFT products is the installed treatment capacities. The difference in installed capacity from one year to the next equals new builds less retirements. Pumps, valves, nozzles, blowers and similar components need to be replaced every 10-15 year. So, unless the new build growth rate is higher than 6%/yr for a component replaced every 15 years or 10%/yr for components replaced every 10 years the replacement market will be larger than the new market. In a high growth country such as India the new build expenditure will be far greater than the replacement, but the total investment will still be small compared to a country such as the U.S. with 40,000 MGD of installed secondary treatment capacity.

It is possible to greatly improve the accuracy of market forecasts by obtaining accurate flow forecasts and then relating the investment for each component as a function of flow rate. The following segments need to be considered. Incremental new systems, new systems which replace retired systems, replacement components, repair and service of existing components.

Over the life of the average pump, blower or high-performance valve the cost of repair will exceed the original cost. As a result, the largest markets for component suppliers are at existing plants in countries with a large installed base.

The movement to IIoT and Remote O&M adds the potential to expand the service and advisory opportunity and to negotiate yearly contracts which can be fixed price or on a partnership basis where the owner and supplier share the savings.

Since owners will be armed with total cost of ownership data due to IIoT and data analytics, the supplier will want to spend the time to prepare a total cost of ownership evaluation. If his is not the lowest then he will need to invest in R&D and be able to submit the Lowest Total Cost of Ownership Validation (LTCOV).

It is highly desirable and possible to forecast the purchases for the few hundred enterprises which buy or influence the majority of the component purchases. BEWG operates more than 300 wastewater plants in China and other countries. Suez operates half the wastewater plants in Chile and remotely monitors plants around the world from a remote center in France. Many countries have privatized wastewater treatment plants. This results in just a few hundred organizations with very large purchases.

Source: The McIlvaine Company