Interact Analysis: Siemens’ Recent Acquisition Takes Advantage of Surging Market

Vanessa Lopez, Research Analyst (Image source: Interact Analysis)

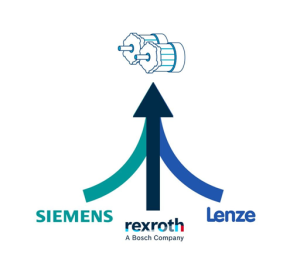

On March 21st, Siemens announced yet another acquisition. In a press release, the company unveiled its plans to acquire ebm-papst’s industrial drive technology (IDT) business. What makes this move most interesting is the acquisition of ebm-papst’s ultra-low voltage motor offering. In a report published by Interact Analysis in late 2023, they found the market for these products is growing strongly, particularly in applications relating to conveying and mobile robotics.

Below, they examine the acquisition announcement in detail and explain why they believe Siemens has made a smart investment.

What does this deal mean for Siemens’ offerings and what is the company’s long-term vision?

From a product perspective, ebm-papst’s portfolio is a valuable addition to Siemens’ portfolio. While Siemens has been active in the ultra-low voltage drive market, it previously lacked a complimentary motor offering. ebm-papst, with over $50 million in sales, ranks 13th in the global market. The majority of its revenue comes from the EMEA region, where it holds 10th position in the regional market. Siemens’ acquisition of ebm-papst’s IDT division opens up wider global market access for these products, leveraging Siemens’ extensive global sales channels.

As stated in the official press release Siemens published in late March, one of the company’s main goals with this acquisition is being able to offer a more complete solution for “… intelligent, battery-powered drive solutions.” While this could include many pieces of equipment, Interact Analysis believes the primary target is mobile robot applications.

Mobile robots are experiencing early-stage growth. As predominantly battery-powered solutions, these robots typically utilize either 24v or 48v DC motors (what they term ultra-low voltage motors). The demand for ultra-low voltage drives and motors is therefore reflecting this upward trajectory. According to Interact Analysis’ ultra-low voltage drives report, revenues are projected to grow at a CAGR of 25.9%, reaching $3.1 billion by 2027. Similarly, ultra-low voltage motors, extensively utilized in mobile robots, are expected to witness substantial revenue growth, reaching $6.5 billion by 2027, as indicated in Interact Analysis’ ultra-low voltage motors report. This surge in demand can be attributed primarily to the burgeoning adoption of mobile robots, particularly in warehouse automation applications.

Also notable is the rapid growth seen by roller conveyors in both segments of the ultra-low voltage markets under discussion. These products are highly compact and often operate at either 12V or 24V, making them an ideal application for ultra-low voltage motors. Moreover, most conveyor manufacturers purchase motors rather than manufacturing them in-house. Interact Analysis' conversations with ultra-low voltage motor vendors consistently highlighted roller conveyors as a significant area of interest for future growth. Interact Analysis estimates this market will nearly double by 2030.

Final thoughts

The accelerated surge in warehouse automation, including the adoption of mobile robots and roller conveyors, presents substantial avenues for Siemens to expand its footprint and secure market share. By strategically aligning itself to meet the escalating demand for ultra-low voltage drives and integrated motor solutions, Siemens is poised to benefit from this surging market. Therefore, they consider Siemens’ acquisition of ebm-papst’s industrial drive technology business as a pivotal and forward-looking investment.

Written by: Vanessa Lopez

Source: Interact Analysis