Efficient Water Usage Through Innovative Filtration

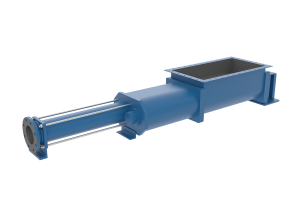

Image source: de.mem

Water scarcity leads to recurring political tensions in many water-poor regions of the world. While large amounts of rainfall have been recorded in Central Europe this year, even water-rich countries like Germany have faced declining groundwater levels and drought periods, which have led to local water extraction bans in the past. This makes it all the more important to conserve the critical resource of water.

The issue has long been recognized by policymakers. Since 2015, the United Nations has emphasized the importance of water through its global initiative for sustainable development and the Sustainable Development Goals (SDGs), which include clean water and sanitation.

In October 2022, the EU published its legislative proposal to revise the existing Urban Waste Water Directive. The stricter rules were passed at the beginning of 2024, with EU countries responding to the increasing contamination of wastewater by pharmaceutical and cosmetic residues.

Policy as an Additional Driver for the Industry

Municipalities and companies must now consider how to meet the new requirements of the directive by upgrading and/or retrofitting their facilities. For the first time, the polluters responsible for contamination are being held financially accountable.

According to calculations by the “Association of Municipal Companies,” the new EU wastewater treatment regulation will likely cost Germany alone nine billion euros over the next 20 years.

Various water filtration solutions are key milestones on the path to clean water. Innovation and expertise can create a wide range of solutions, and companies in the industry are focusing on growth and are specialized in various areas.

One solution is hollow fiber membranes, which can filter out even the smallest contaminants such as bacteria and viruses, as well as microplastics and so-called “forever chemicals” (PFAS). This technology is applicable across many industries, from wastewater treatment in mining to the food industry, including dairy and beverage production. Due to their compact size, these membranes are also used in portable systems or household water filters.

Studies Show High Growth Potential

Studies like those from Grand View Research predict significant growth for the entire industry in the coming years. In 2023, the global wastewater treatment market was estimated at $38.56 billion. By 2030, the average annual growth rate is expected to be 8.1%.

With respect to worldwide hollow fiber membranes use, market studies also forecast strong growth for the global use of these. In 2019, the global market was valued at $9.4 billion, and it is expected to grow to $16 billion by 2026, with an average annual growth rate of 7.9%. Innovations are a major driving force in this market.

From a broader economic perspective, several factors support the growth of this industry, including rising populations in many parts of the world, growth in emerging markets, increasing industrial demand, developments in the food and beverage sector, and the growing need for raw materials and resources.

The demand for household water filtration systems is also expected to rise. According to Grand View Research (November 2022), the U.S. market alone is projected to grow from $12.2 billion in 2022 to $26.7 billion by 2030, with an annual growth rate of 10.5%.

Asia Pacific: An Emerging Region

Experts at Grand View Research currently see the most dynamic growth in the Asia Pacific region, where the market grew by 36.2% in 2023. This is due to the high population and increasing demand for clean and safe drinking water.

Numerous companies are active in this market, offering a wide range of solutions. Some of the companies involved include the conglomerate Pentair (WKN A115FG), BWT Best Water Technology from Austria (WKN 884042), and the Australian specialist De.mem (WKN A2DNYE).

Pentair Covers a Wide Range

The now Irish-based conglomerate Pentair (WKN A115FG) is one of the larger, well-established players. Originally from the United States, the company has been offering a variety of intelligent pumping and water treatment solutions, including membrane technology, since acquisitions in the 1980s. Pentair serves both industrial and private customers.

BWT as a Leading Provider in Europe

BWT Best Water Technology from Austria (WKN 884042) is a manufacturer of specialty chemicals and water treatment systems, particularly for private households. The product portfolio includes the full range of water treatment technologies, such as filtration, alternative lime protection, softening, de-carbonization, and membrane technology (micro, ultra, nanofiltration, and reverse osmosis). Headquartered in Mondsee, Austria, BWT is considered a leading provider of treatment technologies in Europe. BWT's customers include not only private households but also industrial and commercial customers, as well as hotels and municipalities. At the Annual General Meeting in 2015, it was decided that the company merge with the non-listed BWT Holding AG and, accompanying this, that the BWT shares be delisted from the Vienna Stock Exchange.

De.mem Operates in a High-Growth Environment

Unlike the other two companies, De.mem (WKN A2DNYE) is a relatively young, fast-growing player in this market. Furthermore, with headquarters in Australia and a branch in Singapore, it operates in one of the up-and-coming regions of the water market. In Australia, De.mem applies its expertise primarily for clients in the mining sector. In the U.S. market, De.mem has recently received a key certification for household water filtration. The company has grown through several acquisitions in recent years and generates a significant portion of recurring revenues, in part in the form of services and maintenance contracts. In addition, De.mem offers specialized chemicals for filtration systems. The company is specialized in hollow fiber membranes, and its graphene oxide-coated membrane technology, in particular, provides several competitive advantages such as high flow rates and compact size. In Germany, De.mem operates a branch in Velbert and is specialized in industrial clients.

Source: De.mem-GeUTec GmbH