Pumps Market Share to Exceed USD 92.91 Billion by 2028

Pumps Market (Image source: Market Research Future)

Due to the pandemic chemical industry was negatively affected. There was breakage in supply chains, demand and production rate declined. Hence the decrease in growth of the chemical industry resulted in low market growth during the pandemic.

The growth of the pumps market in the U.S. was greatly impacted in 2020 owing to the pandemic, which is reflected by the hang operations and breaking of import-export activities. The market is expected to establish low growth over the predicted period, whereas the demand is majorly assigned to various end-use industries, including power, water & wastewater treatment, and oil & gas.

The rise in investments in the exploration and production activities by the oil & gas companies globally is expected to boost the demand for pumps in the oil & gas industry. The rise in numbers of infrastructure upgrades, in terms of changing and installing new pipelines, is expected to have a positive impact on the market.

Market segmentation

The pump market is segmented into the following component such as product type, Application, region.

By Product Type

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

- Others

By Application

- Agriculture

- Construction & Building Services

- Water & Wastewater

- Power Generation

- Oil & Gas

- Chemical

- Others

Regional analysis

The pump market was operated by Asia pacific for 46.6% of the global revenue share in 2020. Rapid industrialization in the developing economies of Asia Pacific and rising investments in commercial, manufacturing, and industrial projects have contributed to the overall growth of the regional market.

Japan has been focusing on renewable energy sources and natural gas. Companies like JERA have been focusing on adding gas-fired units, fuelling the demand for pumps in the country. The government protocols focused on energy efficiency and conservation is further expected to drive the demand for efficient pumps over the estimated period.

Brazil’s market is expected to have steady growth from 2020 to 2028, owing to a considerable rise in construction activities in the industrial and commercial sectors.

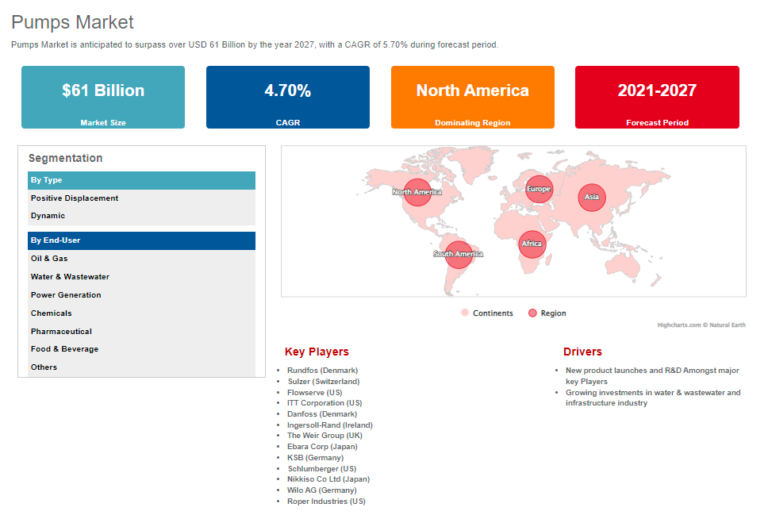

Key Players

The key players of the global pumps market are Grundfos (Denmark), Sulzer (Switzerland), Flowserve (US), ITT Corporation (US), Danfoss (Denmark), Ingersoll-Rand (Ireland), The Weir Group (UK), Ebara Corp (Japan), KSB (Germany), Schlumberger (US), Nikkiso Co Ltd (Japan), Wilo AG (Germany), and Roper Industries (US), among others.

Industry news

- Vacuum pumps market to have 7% CAGR small rising application in the industrial manufacturing sector.

- The solar water pump market is demanding clean energy systems fuelling growth.

- Pumps Market to receive a great hike in revenues by 2029.

Source: Marketresearch.com