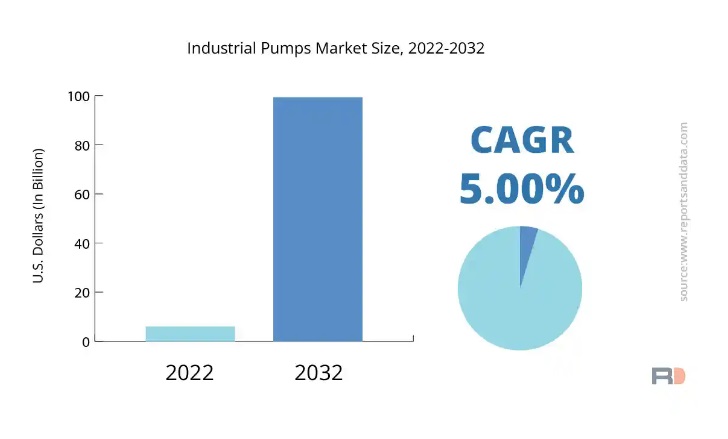

Industrial Pumps Market to Reach USD 99.29 Billion by 2032

Image source: Marketysers Global Consulting LLP

Need for industrial pumps, which are used to carry water, slurry, and other fluids, is increasing as requirement for water and wastewater treatment in the industrial sector is rising. In addition, public awareness about value of clean water and strict regulatory restrictions on the discharge of wastewater into water bodies are rising demand for water treatment and wastewater treatment. In the water and wastewater treatment business, industrial pumps are widely utilised for various processes such as disinfection, coagulation, flocculation, and sludge dewatering.

Top Leading Players:

- Xylem Inc.

- Grundfos Holding A/S

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Ebara Corporation

- Danfoss A/S

- ITT Inc.

- Wilo SE

- Flowserve Corporation

- Weir Group Plc

Further Key Finding from the Report Suggestion:

- The operation of an intelligent motor-pump system in an integrated, coordinated manner can achieve unprecedented and important capabilities for protecting critical processes, process equipment, operations personnel, and the environment. This system also provides a basis for dynamic optimization of critical operating and financial objectives such as long MTBF, low life-cycle cost, or low cost per gallon pumped. Future intelligent systems will provide the basis for next generation CBM systems, future distributed intelligent systems, and autonomous, agent-based systems. These emerging trends are driving increasing automation in the industry

- Centrifugal pumps hold a major share of the Pump Type segment and are expected to maintain this leading position in the Industrial Pump industry during the forecast period

- Water and wastewater treatment plants have a very large market share in the End Use segment. Increase in desalination efforts and regulations curtailing the dumping of industrial wastes will enhance the demand for industrial pumps in this sector

- The construction sector is forecasted to have a high CAGR of 6.1% throughout the forecasted period. The construction boom being seen in the APAC region is pushing the demand for industrial pumps from this sector

- Oil and Gas occupy a significant market share and is forecasted to generate high revenues for the industrial pump market

- Growth in process manufacturing activity will result in an increase in demand for positive displacement pumps

The global Industrial Pumps Market is segmented into:

Type Outlook (Revenue, USD Million; 2019-2030)

- Centrifugal Pumps

- Reciprocating Pumps

- Rotary Pumps

- Diaphragm Pumps

Capacity Outlook (Revenue, USD Million; 2019-2030)

- Small Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

End Users Outlook (Revenue, USD Million; 2019-2030)

- Construction

- Water and wastewater

- Chemicals

- Oil & Gas

- Power Generation

- Others

Regional Outlook:

- North America (U.S.A., Canada, Mexico)

- Europe (Italy, U.K., Germany, France, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- Latin America (Chile, Brazil, Argentina, Peru, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of MEA)