Flowserve Reports Fourth Quarter and Full Year 2006 Results

Flowserve reported significantly stronger financial results for 2006. The Company's announcement highlights record annual sales of $3.1 billion, record annual income from continuing operations of $114 million, a determination of no material weaknesses in internal controls at December 31, 2006 and a positive outlook for 2007.

Also, the Company has declared a $0.15 per share quarterly dividend, payable on April 11, 2007 to shareholders of record as of the close of business on March 28, 2007.

Discussion and Analysis of Full Year 2006 Results (Comparisons to 2005)

Bookings from continuing operations for the full year 2006 increased by 23.4% to $3.6 billion, a Company record. The increase was driven by strength in oil and gas, power and water markets, especially in North America, China and the Middle East. Backlog at December 31, 2006 increased 64.0% to $1.6 billion, as the result of robust bookings, and this improvement positions the Company for a considerably stronger 2007.

Sales for the full year 2006 increased by 13.6% to $3.1 billion, also a Company record. The strong sales growth reflects brisk demand in the oil and gas, power and water industries.

Gross Profit for the full year 2006 increased by 15.7% to $1.0 billion. Gross Margin for the full year 2006 increased by 60 basis points to 32.9%. This margin improvement was largely due to increased sales (which favorably impacted absorption of fixed costs), pricing increases and more selectivity in accepting customer orders, plus successful supply chain and Continuous Improvement Process initiatives.

SG&A for the full year 2006 increased by 14.4% to $783 million. This increase reflects higher commissions from the record bookings, additional sales and engineering personnel in support of the robust sales levels, continued development of in-house compliance capabilities and costs associated with expansion in Asia, as well as increased legal fees and expenses. Costs of equity compensation increased as a result of the adoption of FAS 123R for stock options and the increased share price for restricted stock. SG&A in 2006 also includes realignment charges of $13 million related to relocation of product lines and severance of redundant personnel in certain locations, compared with approximately $2 million in 2005. SG&A also includes $6 million in stock modification charges versus $7 million in 2005.

Income from continuing operations for the full year 2006 increased by 122% to $114 million, a Company record. In 2006, the Company benefited from a reduction of $13 million in net interest costs, $8 million in foreign currency gains in 2006 versus $7 million of foreign currency losses in 2005 and the absence of the debt extinguishment charges of $28 million incurred in 2005 from the Company's successful $1 billion refinancing at lower rates. In addition, the tax rate in 2006 was 39.1%, compared to 44.1% in 2005.

Fully diluted EPS from continuing operations for the full year 2006 was $2.00 per share. EPS as reported includes a $0.15 per share impact related to the previously noted realignment charges of $13 million, related primarily to product line relocation and severance.

Cash flow from operations remained strong in 2006, enabling the repayment of $101 million in debt, repurchase of 1.3 million shares of common stock for $63 million, pension plan contributions of $46 million globally and capital expenditures of $74 million to improve operational capabilities.

Flowserve also continued to expand in its core markets both globally and by market segment in 2006. Oil and gas and power markets continued to fuel the greatest segment growth, with the Middle East and Asia Pacific regions leading the way geographically. "We see robust opportunities in the Middle East and Asia Pacific regions, and we continued to build the infrastructure to capitalize on these opportunities during 2006", said Mr. Kling. "The development of our new plants in China and India plus our work to build a major aftermarket training, repair and service center for our products in Saudi Arabia are two key examples of how we are positioning the Company to succeed in these markets," Mr. Kling went on to say.

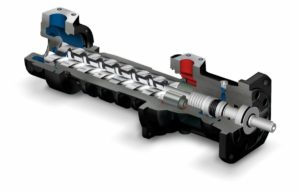

Flowserve Pump Division (FPD)

Bookings for the 4th quarter of 2006 increased 29.2% to $565 million. Bookings for the full year 2006 increased 34.0% to $2.1 billion. Bookings of original equipment, as a percent of total bookings, increased to 61.5% in the 4th quarter of 2006 from 58.7% in the 4th quarter of 2005. Bookings of original equipment for the full year 2006, as a percent of total bookings, increased to 62% from 57% in 2005, due primarily to an increase in large project business. 2006 original equipment bookings grew 46%, aftermarket bookings grew 18% versus 2005. This type of project success provides FPD with increased aftermarket opportunity in the future, which has historically been more profitable than original equipment. The bookings increase is attributable to strength in the oil and gas, power, and water industries.

Sales for the 4th quarter of 2006 increased 24.3% to $501 million. Sales for the full year 2006 increased by 15.7% to $1.6 billion, following an extended period of pump bookings growth. Original equipment sales, as a percent of total sales, increased to 58% in the 4th quarter of 2006 from 53% in the 4th quarter of 2005.

Full year original equipment increased as a percent of total sales to 57% from 53% in 2005, principally driven by oil and gas sales in the Middle East and North America.

Gross margin for the 4th quarter of 2006 decreased 210 basis points to 28.8% reflecting a higher proportion of project-related shipments, which are historically more competitively bid than aftermarket business. Gross Margin for the full year 2006 of 28.3% remained flat. Benefits from improved absorption of fixed costs, as well as process efficiency and supply chain initiatives, were offset by aforementioned shift in sales mix to original equipment, which historically carries a lower margin. For the year ended 2006, original equipment sales increased 23% and aftermarket sales increased by 8% versus the same period in 2005.

Operating Income for the 4th quarter of 2006 decreased by 6.3% to $59 million. The decrease is attributable to the higher proportion of original equipment sales, plus increased SG&A resulting from sales and engineering headcount, sales incentive compensation, third party commissions and travel expenses in support of increased bookings and sales. Operating Income for the 4th quarter of 2006 also includes a $5 million realignment charge for severance associated with the reduction of redundant personnel in Europe. Operating Income for the full year 2006 increased by 15.3% to $173 million. The increase in Gross Profit of $62 million was partially offset by increased commission and travel expense, costs related to increased stock compensation and higher information technology project costs.

Flow Control Division (FCD)

Bookings from continuing operations for the 4th quarter of 2006 increased 7.7% to $255 million. Bookings from continuing operations for the full year 2006 increased by 13.3% to $1.1 billion. The increase is primarily attributable to continued strengthening of several key end-markets. Continued strength in the process valve market resulted from growth in the Asian chemical and coal gasification industries, as well as broad strength in the North American and Middle Eastern oil and gas markets.

Sales for the 4th quarter of 2006 increased by 15.4% to $267 million. Sales for the full year 2006 increased by 11.2% to $995 million. The increase is primarily attributable to the same reasons as the FCD bookings growth.

Gross Margin for the 4th quarter of 2006 increased 260 basis points to 33.1%. The increase in Gross Profit of $18 million and related margin are due to the increase in sales, which favorably impacted FCD's recovery of fixed manufacturing costs, FCD's progress in attaining margin improvements and a large specific warranty charge in 2005. Gross Margin for the full year 2006 increased 180 basis points to 34.0% in 2006. The increase was primarily driven by increased sales, coupled with improved pricing, through an implementation of broad-based price increases in the latter-half of 2005.

Operating Income for the 4th quarter of 2006 increased 35.8% to $26 million. The 4th quarter improvement in gross profit was partially offset by higher SG&A costs, driven by $5 million of realignment charges associated with the relocation of product lines to different facilities, $4 million of selling costs due to the increase in sales and bookings and other costs associated with increased headcount needed to support higher business levels. Operating Income for full year 2006 increased by 25.8% to $116 million. The increase is primarily driven by the improvement in Gross Profit of $51 million, partially offset by higher SG&A. For 2006, approximately $7 million of realignment charges were recognized in SG&A associated with the relocation of product lines to different facilities and $9 million of higher selling costs.

Flow Solutions Division (FSD)

Bookings for the 4th quarter of 2006 increased by 16.7% to $129 million. Bookings for the full year 2006 increased by 9.0% to $505 million. The increase in bookings is due to strong project and original equipment growth as well as robust end-user markets. Success in the end-user market continues to be a strength based on the FSD business model, which places a premium on servicing customers locally through an increasingly larger network of Quick Response Centers (QRCs).

Sales for the 4th quarter of 2006 increased by 12.8% to $131 million and sales for full year 2006 increased by 11.9% to $497 million, both driven by aftermarket and original equipment sales growth in the oil and gas, chemical, and mineral and ore processing industries.

Gross Margin for the 4th quarter of 2006 decreased 150 basis points to 42.0% on higher sales compared with the 4th quarter of 2005. This change reflects higher project shipments in the 4th quarter. Gross Margin for the full year 2006 increased 20 basis points to 44.1%, as a result of various operational excellence initiatives, implementation of price increases and strong aftermarket growth.

Operating Income for the 4th quarter increased 3.9% to $22 million. 4th quarter of 2005 included approximately $2 million of severance costs. Operating Income for the full year 2006 increased 12.6% to $99 million. The positive impact of FSD's global capacity expansion due to the growing QRC network contributed to the increase.

2007 Outlook

Mr. Kling expressed a positive outlook for 2007. He said, "We believe that we are taking market share. And, we continue to see record levels of bookings based on the strength of our products, our global operational capabilities, the talent of our global sales team and the continued strength of our markets." Mr. Kling added, "We expect our 2007 sales to grow double digits in percentage to a range of $3.4 billion to $3.6 billion. We also see further improvement in our gross margins of 25 to 50 basis points since our operational excellence initiatives should gain further traction."

Mr. Blinn added that, "Our SG&A has increased in the past couple of years as we have incurred higher costs to complete our restatement and to further develop in-house capabilities. Further, we have added additional sales resources and engineers to support our business growth. However, we now believe that we have stabilized our cost structure and are well-positioned to realize reduction opportunities. These opportunities include volume leverage, reduced travel, headcount management and operational excellence programs executed at both the corporate and divisional levels. Bottom line, we expect a 175 to 250 basis point improvement in SG&A as a percentage of sales in 2007."

Source: Flowserve Corporation