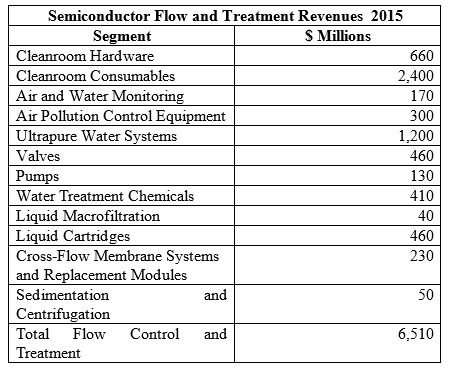

Flow Control and Treatment Sales in the World’s Semiconductor Industry Will Increase

The semiconductor industry has rebounded and will increase its purchases of flow control and treatment equipment for air, water and other liquids and gases to over $6.5 billion in 2015. These forecasts were calculated by McIlvaine Company through aggregation of revenues in a number of McIlvaine market reports.

The biggest expenditures will be for cleanroom consumables. These include masks and clothing which prevent people from contaminating the air in the chip manufacturing space. The ultrapure water systems ensure that the water washing the chips after each step will not contaminate the sub-micron lines etched in the silicon wafers.

Substantial expenditures are needed to purify the water used in the systems. Pumps and valves are specially designed to maintain water and fluid purity.

SEMI, the global industry association for companies that supply manufacturing technology and materials to the world’s chip makers, is forecasting strong growth in 2014 and 2015. Following two years of spending declines, key drivers for equipment spending are investments by foundry and logic fabs for sub-20-nm technology, NAND flash makers for leading edge technology (including 3D NAND) and capacity, DRAM technology upgrades for mobile applications and expansion of advanced packaging capacity for flip chip, wafer bumping and wafer-level packaging. All regions of the world are projected to see equipment spending increases in 2015. Front-end wafer processing equipment is forecast to grow 11.9 percent in 2015 to $34.8 billion, up from $31.1 billion in 2014. The forecast indicates that next year is on track to be the second largest spending year ever, surpassed only by $47.7 billion spent in 2000.

Growth is forecast in all regions except ROW in 2014 and all regions in 2015. Taiwan is forecast to continue to be the world’s largest spender with $11.6 billion estimated for 2014 and $12.3 billion for 2015. In 2014, North America is second at $7.2 billion, followed by South Korea at $6.9 billion. For 2015, South Korea is in second place ($8.0 billion) in spending, followed by North America ($7.3 billion).

In 2014, year-over-year increases are expected to be largest for China (47.3 percent), North America (35.7 percent), South Korea (33.percent) and Europe (29.7 percent). Year-over-year percentage increases for 2015 are largest for Europe (47.8 percent increase), ROW (23.5 percent), Japan (15.6 percent) and South Korea (15.0 percent).

Picture: McIlvaine Company

Source: The McIlvaine Company