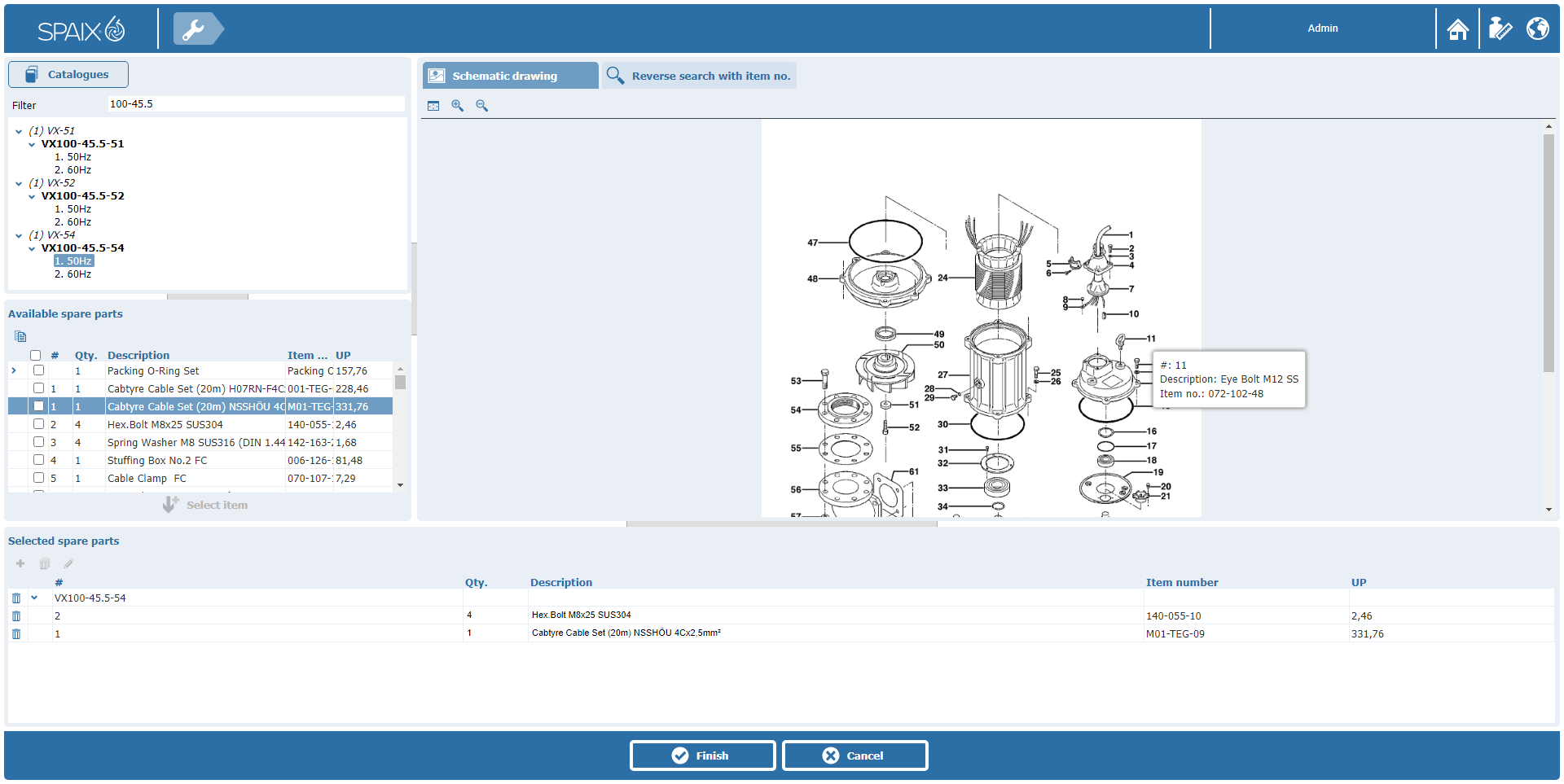

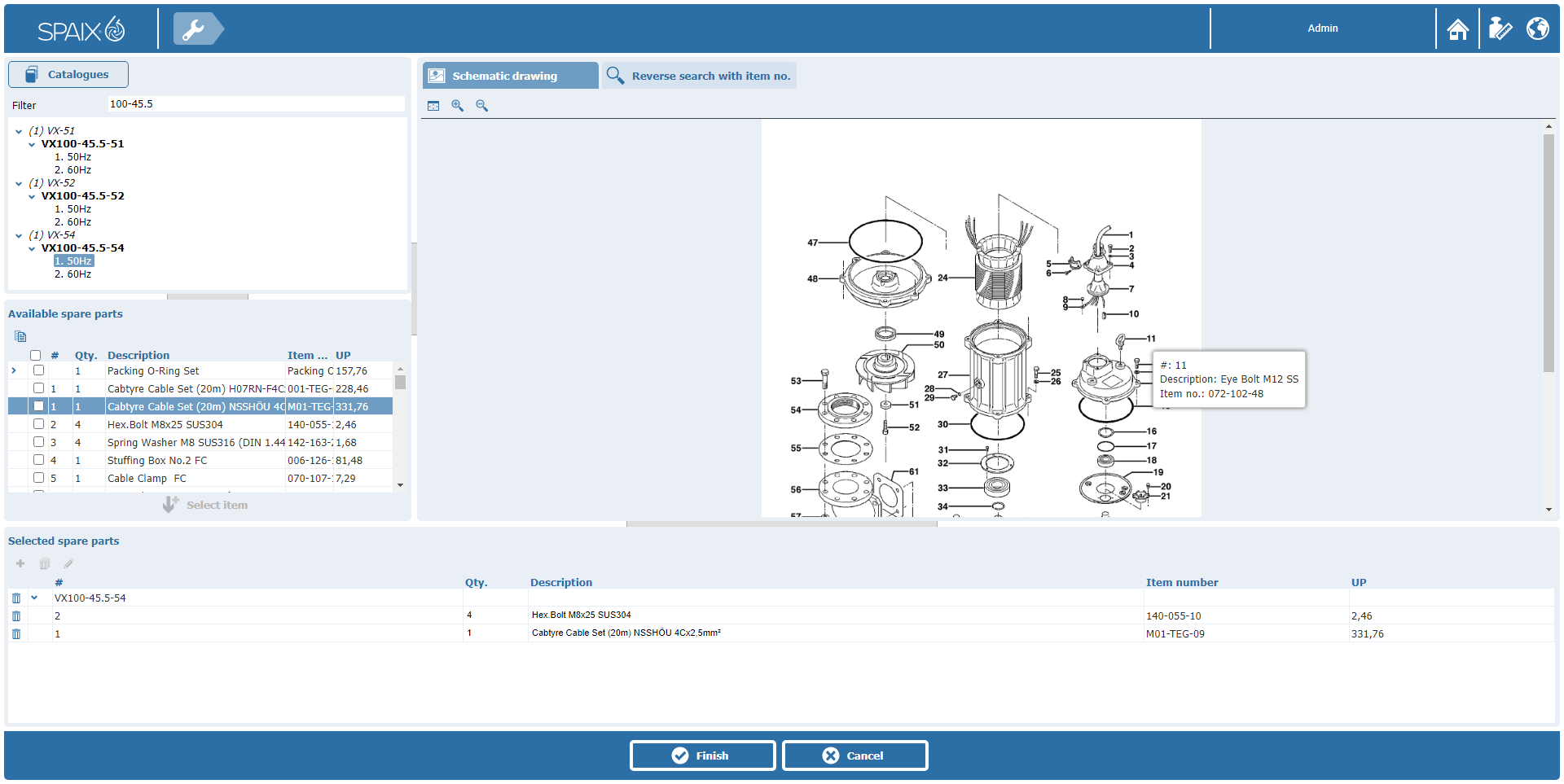

A Powerful Spare Parts Selection Completes the Spaix Software Solution

Offer your customers more value by adding a powerful spare parts search and selection platform to the Spaix pump selection and configuration software.

Read more

Offer your customers more value by adding a powerful spare parts search and selection platform to the Spaix pump selection and configuration software.

Read more

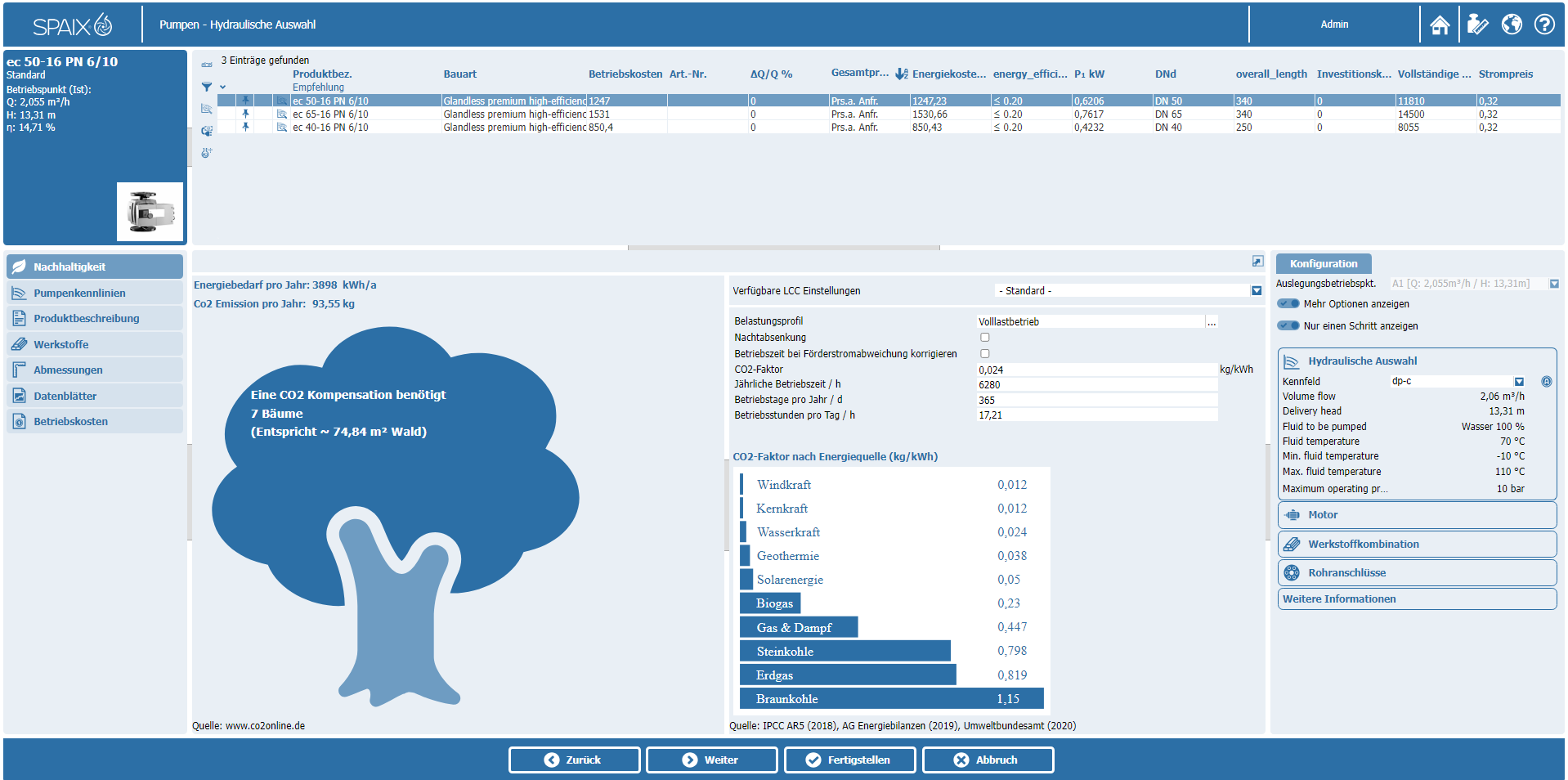

Customers of the Spaix pump selection software have something to look forward to: the latest version will be launched at the end of October. In addition to many new functions, the program’s performance has been further improved. Moreover, the manufacturer VSX – VOGEL SOFTWARE has paid special attention to the topic of sustainability in Spaix 6.

Read moreFEB 01, 2001

Today, United Dominion announced its earnings for 2000. Net income, before non-recurring items, totaled $94.7 million ($2.42 per share) on sales of $2.4 billion. Earnings per share before non-recurring charges were flat year-over-year on a 10% increase in sales. Per share results for the year were calculated on 39.1 million shares outstanding, compared to 39.6 million shares last year.

Read moreHOUSTON–(BUSINESS WIRE)–Feb. 8, 2001–National-Oilwell, Inc. (NYSE:NOI) today reported fourth quarter net income, excluding noncash special charges, of $18.6 million ($0.23 per diluted share), up from $11.9 million ($0.15 per diluted share) in the third quarter of 2000 and up from near breakeven results in the fourth quarter of 1999. Revenues for the fourth quarter of 2000 were $329.4 million, 15% above the third quarter of 2000 and 48% above the fourth quarter of 1999.

Read moreDALLAS, Feb. 6 /PRNewswire/ — Flowserve Corp. (NYSE: FLS) today announced

fourth quarter 2000 net income of 50 cents a share, an increase of 117 percent

compared with 23 cents a share in the fourth quarter of 1999, before special

items in both periods.

Read moreCHARLOTTE, N.C., Feb 1 /PRNewswire/ —

United Dominion Industries Ltd. (NYSE, TSE: UDI) today announced 2000 net income, before non-recurring items, totaled $94.7 million ($2.42 per share) on sales of $2.4 billion. Earnings per share before non-recurring charges were flat year-over-year on a 10% increase in sales. Per share results for the year were calculated on 39.1 million shares outstanding, compared to 39.6 million shares last year.

Read moreABS has undertaken a re-organisation aimed towards an even stronger focus on customer applications and processes. As from January 1, 2001, ABS was divided into three business divisions Water & Waste Water, Building Services and Industry.

Read moreReport on the Financial Year 2000: Sustained economic activity

The positive developments in the economy worldwide continued into the second half of the year and, despite first signs of weakness, provided a predominantly stable economic framework. With one or two exceptions, Western European markets also experienced good overall growth. In Germany, this was driven largely by exports, however. The construction industry continued to show no sign of recovery.

Read moreLOUISVILLE, Ky., Jan. 25 /PRNewswire/ — Thomas Industries Inc.

(NYSE: TII) will hold a Webcast to address its fourth quarter and year-end

financial results on Wednesday, January 31, at 11:00 a.m. (EST). Interested

parties may connect to the audio conference at http://www.thomasind.com. A replay will be available on this Web site for 90 days.

Read moreWHITE PLAINS, N.Y., Jan. 23 /PRNewswire/ — ITT Industries, Inc.

(NYSE: ITT) today reported full year 2000 net income of $264.5 million and

diluted earnings per share (EPS) of $2.94, up 15 percent and 18 percent

respectively over the full year 1999, excluding a non-recurring item reported

in the fourth quarter of 1999. Full year revenues from ongoing segments rose

5 percent to $4.8 billion. Full year segment operating income for 2000 was

$546.8 million, up $78.6 million or 17 percent from the year earlier, due to

full year segment operating margin growth of 1.2 percentage points to

11.3 percent.

Read moreConsolidated order intake for 2000 by the Sulzer Corporation totalled CHF 5775 million, 7% higher than in prior year. Growth adjusted for acquisitions and divestitures was 11%, and 7% after adjustment for currency effects. Sulzer Medica attained a nominal growth of 14% (8% adjusted for currency effects), while Sulzer Industries order intake rose nominally by 5%, or 10% adjusted for acquisitions and divestitures.

Read more