The Impact of Non-Traditional Needs and Solutions on Pump Industry Profitability

Investors are attracted to pump companies because of the large size of the pump market and the fact that their products are needed in growing industries such as water treatment.

McIlvaine Company

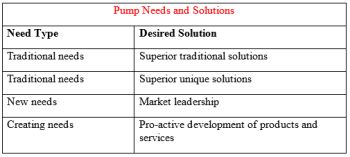

Investment analysts do a good job of predicting the profitability of the segments of the market dealing with traditional needs and traditional solutions but have difficulty anticipating the impact of non-traditional needs and solutions.The future in the case of non-traditional needs and solutions will not be an extension of the past.

We are now at the bottom of a pump industry cycle. The fortunes of the companies focusing on traditional solutions tend to look brighter than the fortunes of those who rely in part on non-traditional solutions. If we look out five years, we need to take into account four scenarios.

The traditional needs are exemplified by the municipal wastewater industry. Processes are slow to change. Because of the nature of the bidding process, traditional solutions are encouraged. An oil and gas floating platform lends itself to unique solutions. A pump requiring less maintenance is valued more highly when the service engineer has to make a boat trip to make repairs. The high pressures and unique conditions to which subsea pumps are exposed dictates new solutions. The development of pumps for energy recovery in desalination reverse osmosis (RO) plants is one of many examples where a need was created by a technical development.

As the pump industry rebounds, there will be many opportunities for market leadership and development of new products and services. Analysts should take this into account in their assessment of various pump companies.

Xylem and Flowserve are two of the four leading pump companies in the world. They have different markets and strategies.

Xylem exemplifies a large supplier targeting superior traditional solutions. It is focused on industries with slow but steady growth. It is the world s fourth largest supplier with pump revenues of $2.1 billion. Total revenue in 2015 was $3.65 billion which was down $200 million from an average of the previous two years. Despite lower sales, the operating margin was up from 11.8 percent in 2013 to 12.9 percent in 2015. On the other hand, R&D dropped $10 million to $95 million and represented 2.6 percent of sales in 2015.

The 2015 revenue split was 44 percent industrial, 33 percent public utility, 21percent residential and commercial and 2 percent agricultural. Transport generated 41percent of the revenues and building services 21 percent. The pump or transport activities are complemented by treatment and test products. More than 40 percent of revenues come from repair and services. Most of the industrial revenues come from transport of water. For example, a power plant extracts river water in the same quantities and manner as does a water utility.

Due to the fact that many of the customers are public utilities, there is an inherent resistance to change and a focus on initial price rather than total cost of ownership. Forty-one percent of the present revenues are in the U.S. compared to only 13 percent in the Asia/Pacific region. Application of superior traditional solutions leveraged by the U.S. experience offers substantial growth opportunities in Asia/Pacific.

Flowserve has a business model which lends itself to capitalize on "new needs." It focuses on cyclical markets but ones with long-term positive drivers. 2015 sales were $4.6 billion. Oil and gas accounts for 36 percent of sales whereas "water" accounts for only 4 percent. Thirty percent of Flowserve s revenues come from engineered pumps, seals, and systems. Flowserve and Xylem have not competed with each other since the Xylem/ITT split which resulted in the industrial pump activity remaining with ITT.

The cycle magnitude has been reduced by the change in mix of orders. Traditionally new large projects accounted for 20 percent of sales. Now it is between 10 and 15 percent. Short-term smaller projects such as replacement and upgrading now account for more than 40 percent of sales. The aftermarket segment now represents more than 40 percent of sales. The big drop in sales to the oil and gas industry has reduced earnings but cost reductions have partially offset the revenue losses.

The challenge for Flowserve and similar companies is to minimize profit reductions in the low end of the cycle and maximize opportunities at the high end. Manufacturing migration is one of the steps the company is taking as it right sizes its assets to deal with geographic market conditions.

Another challenge is to leverage the "engineered solutions" to provide products with lower total cost of ownership. Life of pump parts in applications such as fracking is measured in months. So there are major opportunities to differentiate themselves with superior materials and designs.

Source: The McIlvaine Company