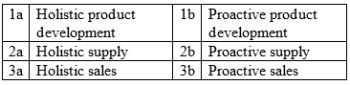

The Flow Control Future Belongs to International Companies with Holistic and Proactive Development, Supply and Sales Programs

The $350 billion flow control and treatment market is undergoing a steady change caused by growth disparity between regions and expansion of international companies in the high growth regions.

The differences can be attributed to six factors (Image: McIlvaine Company)

There have been many acquisitions in recent years as international companies seek to adjust to these changes. However, acquisitions are only part of the adaptation process. Some international companies are very successful in their expansion efforts. Others are not doing as well.

Product development is much more important in flow control and treatment than in some other industries where the pace of change is slow. A holistic program takes into account the range of opportunities whereas a myopic program is the victim of an existing culture e.g., IBM and personal computers. W.L. Gore has developed unique products in retail clothing as well as flow control and treatment where it supplies pump packings, liquid filtration bags, gas turbine filters, dust collector bags, NOx and VOC removal technologies and most recently a novel device for mercury removal. The company shows the holistic strength by the breadth of industries and products. It has demonstrated its proactive strength by unique approaches which take an industry in a different direction.

Companies without strong product development programs complain that the Chinese are stealing their designs. Thermo Fisher, with a strong development program, has built its main air pollution research center in China.

Supply includes manufacturing, purchasing, engineering and service. International flow control companies have been investing in manufacturing facilities in Asia. Filtration media companies have been generally successful in setting up plants in China. The biggest opportunity lies in a holistic approach which combines manufacturing with service. Pentair, for example, has worked on a repair business based on expensive valves which can be repaired rather than replaced. This initiative combines the holistic manufacturing/repair combination plus the proactive concept to take the industry in a new direction.

The potential for remote monitoring, service and then maintenance support can be realized with holistic and proactive approaches. This potential is highest in developing countries moving to high tech production e.g., pharmaceuticals in India, semiconductors in China and ultrasupercritical coal-fired power plants in Vietnam.

Most international companies are failing to take the proper holistic approach to sales. Divisions are not sharing intelligence or collaborating. Management has initiated top down approaches to take advantage of synergies but efforts have often been unsuccessful. There is considerable potential for multi-company initiatives. Various governments are helping. The Italian government has a strong initiative to promote industrial valve exports. The Industrial Valve Summit held last year in Bergamo, Italy was an effective promotional aid to the Italian valve manufacturing industry.

The McIlvaine Company is focused on helping international companies with all six of the important factors for international success. In addition, McIlvaine is creating unique tools which can be shared by suppliers and end users around the world. They include:

- Decision guides with classification of options for each industry.

Cross pollination among industries: McIlvaine conducted a cross industry pollination webinar on mercury removal for sewage sludge incinerators, coal-fired boilers, cement plants, waste-to-energy plants and natural gas pipelines. New developments applied to natural gas pipelines may be applicable to the other industries. Decision guides on NOx, hot gas filtration and acid gas removal in multiple industries will be discussed in a series of webinars in March and April.

- White papers and analyses on products focused on the total cost of ownership.

- Identification of all supplier and end user parent companies by a corporate identification number with spelling in Chinese and English.

- Supplier programs including many market reports and databases along with KOC Sales Strategy, 4 Lane Knowledge Bridge, and Detailed Forecasting of Markets, Prospects and Projects.

Source: The McIlvaine Company