National Oilwell Varco’s First Quarter 2006

National Oilwell Varco reported that for its first quarter ended March 31, 2006 it earned net income of $120.3 million, or $0.68 per fully diluted share, compared to fourth quarter ended December 31, 2005 net income of $101.6 million, or $0.58 per fully diluted share.

The results include $14.7 million of pre-tax charges ($0.06 per share after tax) related to Varco International, Inc. integration costs ($7.9 million pre-tax or $0.03 per share after tax) and stock-based compensation charges related to the expensing of options ($6.8 million pre-tax or $0.03 per share after tax). Excluding integration and stock-based compensation charges, earnings were $0.74 per fully diluted share.

Reported revenues for the quarter increased 9.8 percent sequentially to $1,511.8 million, and operating profit was $212.5 million, an increase of 19.9 percent over the fourth quarter, excluding integration and stock-based compensation charges from both periods. Operating profit flow-through, or the increase in operating profit divided by the increase in revenue, was 26.2 percent from the fourth quarter of 2005 to the first quarter of 2006, and was 26.2 percent from the first quarter of 2005 to the first quarter of 2006, excluding integration and stock-based compensation from all periods.

Backlog for capital equipment orders for the Company's Rig Technology segment at March 31, 2006 rose 39 percent over the prior quarter to $3.2 billion, compared to $2.3 billion at December 31, 2005, with new orders during the quarter of $1.3 billion. The increase in the Company's backlog for capital equipment reflected the strong demand for its drilling equipment products, particularly for many new offshore rigs currently under construction.

Pete Miller, Chairman, President and CEO of National Oilwell Varco, remarked, "Our company is off to a great start in 2006. We enjoyed strong demand for our oilfield products and services during the quarter, with all three of our segments reporting higher sales, operating profit and operating margins over the prior quarter and the first quarter of last year. We continue to see tremendous demand in this market, and believe that worldwide oil and gas market activity will remain strong through 2006."

"We have largely completed our integration activities associated with the merger between National-Oilwell and Varco, which closed March 11, 2005, and are benefiting from about $15 million in savings each quarter. As a result, our outlook for the remainder of the year is very good."

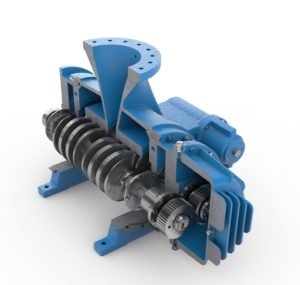

Rig Technology

First quarter revenues for the Rig Technology segment increased by 11.0 percent over the fourth quarter to $715.3 million, mainly due to growing demand for drilling and well-servicing equipment. Operating profit for this segment was $100.8 million, or 14.1 percent of sales, representing an increase of $20.3 million from the fourth quarter. Operating profit flow-through from the fourth quarter of 2005 to the first quarter of 2006 was 29 percent, excluding integration and stock-based compensation from both periods. Revenue out of backlog for the segment rose 18 percent sequentially, to $421 million.

Petroleum Services & Supplies

Revenues for the first quarter of 2006 for the Petroleum Services & Supplies segment were $541.0 million, up 5.4 percent compared to fourth quarter results. Operating profit increased sequentially by 16.7 percent to $118.3 million or 21.9 percent of revenue during the first quarter. Operating profit flow-through from the fourth quarter of 2005 to the first quarter of 2006 was 61 percent. High flow-throughs resulted from higher volumes and pricing in most oilfield markets around the world, partly offset by higher employee benefit costs, and seasonally lower results in this segment's fiberglass operations in China and its pipeline inspection operations. The group's Mission drilling expendables, Griffith/Vector downhole tools, Brandt solids control, and Quality Tubing coiled tubing brands all posted double digit growth sequentially.

Distribution Services

The Distribution Services segment generated first quarter revenues of $326.5 million, representing a 5.9 percent increase from the fourth quarter. First quarter operating profit was $20.8 million or 6.4 percent of sales, $5.9 million higher than the fourth quarter. The significant improvement in operating profit margins for this segment over the prior quarter was due to lower costs and higher sales volume, primarily in Canada, Texas, and the mid-continent region of the U.S.

Source: NOV, Inc.