McIlvaine: Pump Forecasts for Strategy and Sales Planning

650,000 Pump Forecasts for Strategy and Sales Planning. (Image source: The McIlvaine Company)

With 130,000 forecasts the McIlvaine World Pump market report has already become a basic tool for setting individual salesman quotas, making R&D and manufacturing investment decisions, and guiding promotional choices. Individual forecasts are provided in each country for 15 applications and for four pump types within each application for a period of nine years.

What is new is further segmentation by performance which adds more than 520,000 additional forecasts.

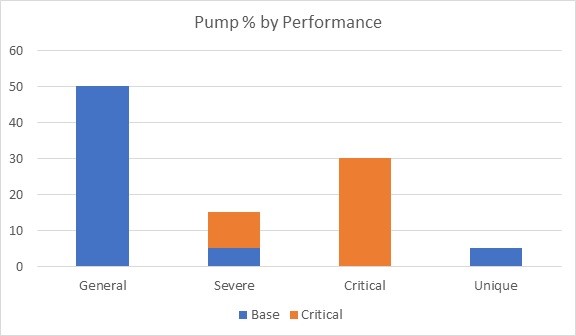

For each pump type, there are forecasts for 80 countries and sub regions further segmented by 15 applications. Forecasts are provided for future years through 2025 and historical revenues from 2016. Now there is further segmentation by four performance factors. The segments are general, severe, critical and unique.

Purchasers make decisions based on price versus performance. One adage is that there is price, performance, and delivery time. You can only have two out of the three.

Pump companies should forecast markets based on performance for several reasons.

- to be able to maximize production to match sales potential

- determine the best distribution routes

- create the best sales strategy

- determine best manufacturing techniques e.g. in house hard coating vs sub-contracting

General performance involves pumps of standard construction which are likely to be replaced rather than maintained when problems occur.

This is a category where price and delivery are of higher importance than minor performance differences. Substantial quantities of these pumps are manufactured in countries with low labor costs and weak environmental standards.

Severe Service: Corrosion, pressure, temperature, and process operating fluctuations are all conditions that qualify an application as severe service.

Critical Service: Safety, product purity, continuous operation, and product toxicity are criteria of critical service. These are also considered essential for the operation of the plant. However, this category excludes critical pumps which are also in severe service.

Unique Service: The distinction is often made between an engineered pump versus an off the shelf or standard. So unique pumps would be engineered pumps which are not in severe or critical service but would be engineered because of size or special designs.

Customized versions of the forecasts are available. For example rotary pumps can be divided into six categories. The U.S. can be divided into nine regions or 50 States. China and Canada can be segmented by province.

The forecast of pump revenues based on pump performance will allow management to better determine manufacturing and sales strategies and to optimize the opportunities and maximize profits. Higher profit margins are achievable with pumps which are considered to be better than general performance.

Source: The McIlvaine Company