Large Treatment and Flow Control Companies Expect to Grow 5.2 Percent in 2013

Eighty major companies participating in the air, gas, water, fluid treatment and control market expect their 2013 sales to be $114 billion up from $108 billion in 2012 for an average gain of 5.2 percent.

The mean gain is 5.6 percent (the projected sales for the company ranked #41). The McIlvaine Company in its report, Air/Gas/Water/Fluid Treatment and Control: World Markets, is projecting sales in this market to increase worldwide from $323 billion in 2012 to $339 billion (in non-inflated 2010 dollars).

Many of the companies participating in this market derive the majority of their sales from products outside the scope of this forecast. These 80 larger companies generate only 15 percent of the revenues in this market. The conclusion is that the larger companies will be growing at the same rate as the total market.

Companies headquartered in Asia (with the exception of Japan) will in general be growing faster than companies headquartered in Europe and the Americas.

Future sales forecasts of each of the 80 companies are an aggregate of forecasts by the companies or by the analysts who follow their stocks most closely. Individual forecasts ranged from a negative 3 percent to a positive 22 percent.

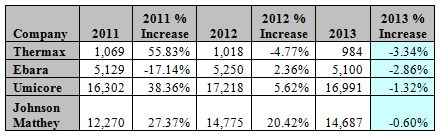

Low Growth Companies (Revenues $ Millions)

In the case of companies projecting lower sales in 2013, the reason is exceptionally high increases in 2011 or 2012

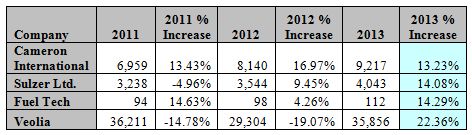

High Growth Companies (Revenues $ Millions)

The companies projecting higher sales ranged from those with steady high growth to companies which expect to rebound from low or negative growth.

Source: The McIlvaine Company