Interact Analysis: German Manufacturing On The Mend

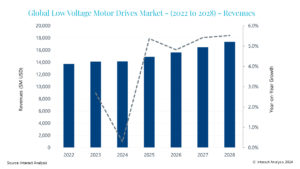

The next contraction for German manufacturing is forecast for 2023. (Image source: Interact Analysis)

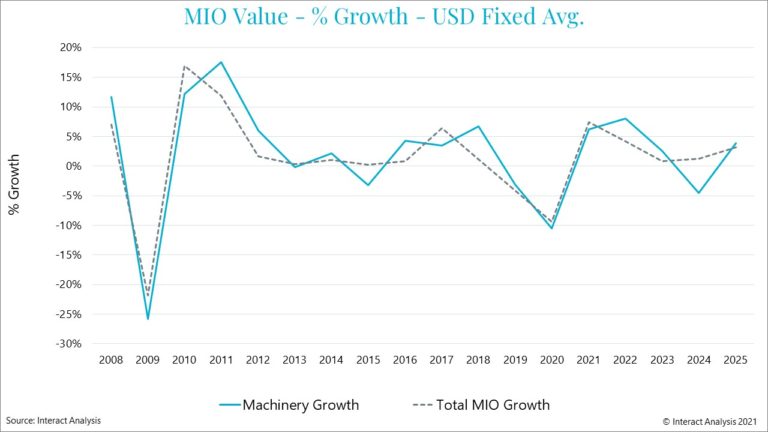

The hangover from the pandemic has manifested itself in a number of specific ways. Supply chains have been badly disrupted, transport and raw material costs are up, and there is a major labour shortage in many countries. Additionally, reciprocal pressure (i.e. a high recovery rate in economies that experienced sudden economic declines in 2020) means that the current projected 2021 growth rate is not a good indicator for the long-term.

In this insight, we take a look at German manufacturing, where COVID-19 recently forced the cancellation of the leading global show for advanced manufacturing and industrial technologies: Smart Production Solutions (SPS) in Nuremberg. Notwithstanding the sudden COVID-19 resurgence, all indicators point to good growth in 2021, but a long-term German recovery is potentially going to be hampered by a particular structural weakness in its manufacturing economy: an over-reliance on exports.

Lack Of Full Lockdown = Weaker Reciprocal Pressure

A few weeks ago, outgoing German Chancellor Angela Merkel told the country that a fourth wave of COVID-19 was hitting Germany with ‘full force’. But back in 2020 Germany was one of the few Western European countries that enforced only partial lockdowns, allowing most normal business activity to continue. This meant output remained relatively stable, as is reflected in Eurostat monthly growth data. Rather than being forced to shut down like in many other regions, firms were allowed to continue operating as long as they applied social distancing rules and other protective measures.

That said, sectors such as automotive did shut down plants for a period of weeks in order to adapt production measures to the new COVID rules, or because production in the new conditions became unfeasible, or because of disruption to supply lines. But all-in-all the impact of COVID-19 on manufacturing output was not as serious as first thought. There is therefore a lack of reciprocal pressure, meaning the predicted German growth rate of 7.5% for 2021 is a little weaker than some other countries – such as the UK which is forecast for 8.6%. Nevertheless, the German figure is an indicator of good growth.

But German manufacturing has now to weather the latest COVID-19 wave. Hopefully the experience of 2020 will stand the sector in good stead. In line with the established cyclical patterns caused by fluctuating waves of demand across our MIO forecast regions, the next contraction for German manufacturing is forecast for 2023.

Semiconductors And Electronics Lead The Way; Automotive Fighting Back

Currently, semiconductors and electronics are performing strongly in Germany, with growth approaching 14.5%. After a traumatic 2020, automotive production is recovering well, with expected growth also at 14.5% in 2021, after a -24% contraction in 2020, but we do not expect automotive production to surpass 2019 levels until 2025. Rubber and plastics machinery, farming machinery and textile machinery are expected to grow by in excess of 15% in 2021, but the aerospace sector is still bumping along the bottom: a -12.5% dip is predicted to be followed by a mere 1.4% growth in 2021.

A ‘Dangerous Export Fetish’?

A recent article by German political science professor Andreas Nölke, highlighted an interesting and unusual characteristic of the German economy: a ‘dangerous export fetish’, i.e. an overwhelming reliance on exports. Arguably, an economic model in which exports make up 43.5% of GDP (for China, the figure is 18.4%), makes the country’s economy peculiarly vulnerable to any international disruptions. According to Nölke, German exports fell 9.3% in the last year which, he says, is the biggest downturn since 2009.

Going forward, the big difficulty for German manufacturing exporters may be the growing geopolitical tensions between China and the USA. If tensions get worse, countries such as Germany that trade heavily with those economies may find that trade simply cannot continue at the same levels in the long-term.

Author: Adrian Lloyd, CEO of Interact Analysis

This insight draws on the recently updated Manufacturing Industry Output Tracker – a complete and unified analysis of global manufacturing output.

Source: Interact Analysis