Flowserve Corporation Reports Third Quarter 2020 Results

Third Quarter 2020 Highlights (all comparisons to the 2019 third quarter, unless otherwise noted)[1]

- Reported Earnings Per Share (EPS) of $0.39 and Adjusted EPS[2] of $0.50

- Reported EPS includes after-tax adjusted items of approximately $14.3 million, including realignment, transformation and below-the-line foreign exchange impacts

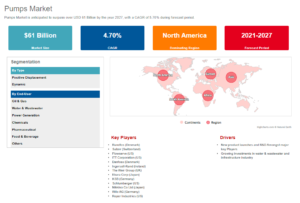

- Total bookings were $806.1 million, down 21.2%, or 21.6% on a constant currency basis

- Original equipment bookings were $381.0 million, or 47% of total bookings, down 28.3%, or 29.0% on a constant currency basis

- Aftermarket bookings were $425.1 million, or 53% of total bookings, down 13.5%, or 13.6% on a constant currency basis

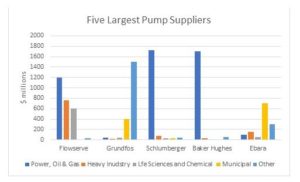

- Sales were $924.3 million, down 7.2%, or 7.7% on a constant currency basis

- Original equipment sales were $479.4 million, down 5.6%, or 6.3% on a constant currency basis

- Aftermarket sales were $444.9 million, down 8.8% reported and on a constant currency basis

- Reported gross and operating margins were 30.9% and 9.4%, respectively

- Adjusted gross and operating margins[3] were 31.5% and 10.9%, respectively

- Backlog at September 30, 2020 was $2.0 billion, down 4.2% sequentially

“We delivered a solid operating quarter as we continued to refine and improve our processes to more effectively manage the pandemic-related challenges,” said Scott Rowe, Flowserve’s president and chief executive officer. “Our front-line workers and operating leaders are continuously improving their ability to limit COVID disruptions in our facilities, demonstrating their commitment to each other and our customers to safely deliver critical support, products and services.”

“Despite the challenges with COVID, we continue to execute the Flowserve 2.0 agenda and advance our long-term strategic plan,” added Rowe. “The transformation has enabled us to achieve our $100 million annualized cost savings target, as well as manage our margins and decrementals better than previous cycles. Additionally, we launched five new and four upgraded products during the quarter targeting attractive process applications. We believe these actions will continue to position Flowserve for long-term success as our end-markets begin to recover in 2021.”

Outlook

Rowe concluded, “Looking forward, we are increasingly optimistic that our markets have stabilized, and we can expect a return to growth in 2021 as the world recovers from the COVID pandemic. I am confident that with continued Flowserve 2.0 transformation progress we will be well positioned to capture growth opportunities when investment returns, driving long-term value for our customers, associates and shareholders.”

As announced on April 6, 2020, Flowserve withdrew its full year 2020 guidance in light of the significant market uncertainty as a result of the COVID-19 pandemic, and its related affects. In terms of fourth quarter outlook, Flowserve’s results are traditionally seasonal during the year – with the highest performance for quarterly revenues, adjusted earnings and cash flow typically occurring in the fourth quarter of the year. We expect the 2020 fourth quarter to largely follow that trend.

Revision to Prior Periods

The company also announced that in conjunction with its close process for the 2020 third quarter, the company identified and corrected immaterial accounting errors related to the recognition of a liability for unasserted asbestos claims, as well as certain other immaterial adjustments. As part of its review of this accounting treatment, the company retained a third-party actuarial consultant to review information pertaining to our potential asbestos liability. Based on the results of this analysis, the company recognized an ‘incurred but not reported’ (“IBNR”) liability during the year ended December 31, 2014 through the second quarter of 2020. The company does not have an increased view of risk related to asbestos litigation or a change in expectations for future cash flows.

The cumulative effect of these corrections resulted in an increase in liabilities including an IBNR for unasserted asbestos claims of approximately $66 million, as well as an increase to total assets of approximately $23 million and a decrease to retained earnings of approximately $43 million as of June 30, 2020. The expected impacts of the revisions described above and reflected in the supplemental schedules attached as Exhibit 99.2 to the Form 8-K filed in connection with this earnings release are preliminary and unaudited and are subject to change before filing the September 30, 2020 Form 10-Q.

While the revisions are not material to any prior annual or quarterly period, to enhance transparency, the company plans to provide revised comparative periods in future filings, including in its September 30, 2020 Form 10-Q, which the company expects to file within the prescribed timeline for such report, including any available extension.

[1] Prior period comparisons are impacted by the accounting revision related to incurred but not reported accruals for expected future asbestos litigation as well as certain other non-material adjustments further detailed in “Revisions to Prior Periods” section.

[2] See Reconciliation of Non-GAAP Measures table for detailed reconciliation of reported results to adjusted measures.

[3] Adjusted gross and operating margins are calculated by dividing adjusted gross profit and adjusted operating income, respectively, by revenues. Adjusted gross profit and adjusted operating income are derived by excluding the adjusted items. See reconciliation of Non-GAAP Measures table for detailed reconciliation.

Source: Flowserve Corporation