Commercial Rebound At Sulzer Under Way

Image source: Sulzer Ltd.

"Our Applicator System division strongly rebounded in the third quarter on continued market reopening and customer restocking. With the closing of the Haselmeier acquisition, we complemented our portfolio of healthcare applicators and are well positioned to seize growth opportunities in the fast-growing drug delivery devices market.”

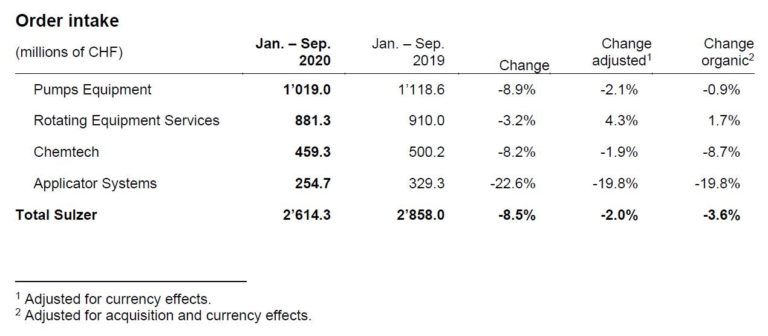

In the first nine months of 2020, order intake declined by CHF 243 million, minus 2% currency-adjusted and minus 3.6% organic. Currency impact was a negative 6.5% and acquisitions contributed CHF 44.9 million.

Organic order intake in Sulzer’s end markets was mixed: orders from oil and gas grew organically by 1.7% compared with the same period a year ago, while chemicals were organically flat (-0.6%). The municipal water market held up well and our water segment was flat organically, excluding two large water infrastructure projects booked in the Middle East last year. Orders from the power market were also flat for the nine-month period, dampened by pandemic-driven site access restrictions in our service business. In Applicator Systems, significant order growth in healthcare could not offset the impact of lockdowns on the beauty and dental markets, but all applicator segments rebounded strongly in Q3 on continuing market reopening, doubling sequentially.

Orders increased in Asia-Pacific (+3.1% organic) and declined in EMEA (-6.3% organic) and the Americas (-4.8 % organic).

Haselmeier acquisition

Sulzer completed its acquisition of drug delivery device developer and manufacturer Haselmeier on October 1, 2020.

The EUR 100 million transaction offers substantial value creation potential as Sulzer complements its healthcare portfolio and leverages its APS expertise in precision injection molding to seize growth opportunities in the fast-growing drug delivery device market. The integration of the acquired business is expected to generate cost synergies through insourcing and leveraging the scale of the combined businesses.

Outlook 2020

The current business environment continues to be characterized by high uncertainty, driven by the continued spread of COVID-19 and its economic impact. For the full year, we expect organic order intake to be down 3 to 4% and organic sales to be down around 5% on a continued rebound in the fourth quarter 2020.

The ambitious cost measures are on track to deliver the targeted savings and mitigate the impact of the pandemic. Sulzer will deliver the full CHF 60m of its OPEX squeeze as planned in 2020, with CHF 45m already achieved. Furthermore, the structural measures to resize our energy business are on track to yield recurring savings of CHF 70m, most of which will impact our P&L in 2021. All actions are launched and progressing well. Corresponding costs of CHF 80m, mostly restructuring, will be recognized in 2020.

Sulzer confirm its guidance on operational profitability for the full year 2020, which is estimated to land towards the middle of the 8.5–9.0% range previously indicated, and the expected rebound around pre-pandemic levels for the full year 2021.

Source: Sulzer Ltd.