Baker Hughes Announces Third Quarter Results

Baker Hughes Incorporated announced adjusted net income (a non-GAAP measure) for the third quarter of 2012 of $322 million or $0.73 per diluted share. This compares to adjusted net income of $1.18 per diluted share for the third quarter of 2011, and $1.00 per diluted share for the second quarter of 2012.

Adjusted net income for the third quarter of 2012 excludes an after-tax charge of $28 million ($0.07 per diluted share) related to internally developed software and other information technology assets. It also excludes an after-tax charge of $15 million ($0.03 per diluted share) related to the closure of a chemical manufacturing facility.

Adjusted net income for the third quarter of 2012 includes after-tax charges of $27 million ($0.06 per diluted share) for bad debt provisions in Latin America and Europe.

Net income attributable to Baker Hughes (a GAAP measure) for the third quarter of 2012 was $279 million or $0.63 per diluted share compared to $1.61 per diluted share for the third quarter of 2011, and $1.00 per diluted share for the second quarter of 2012. Please see Table 1 for a reconciliation of GAAP to non-GAAP Financial Measures.

Revenue for the third quarter of 2012 was $5.23 billion, up 3% compared to $5.06 billion for the third quarter of 2011 and remained relatively flat compared to $5.21 billion for the second quarter of 2012.

"For the third quarter, Baker Hughes revenue was flat, despite a drop in U.S. and international rig counts," said Martin Craighead, Baker Hughes President and Chief Executive Officer. "However, our margins were impacted by the well-known imbalance in the North American Pressure Pumping business. Additionally, activity was less than planned in several key geomarkets for Baker Hughes, resulting in an unfavorable mix. The clearest example is Canada, where the seasonal return of activity was nearly 30 percent less than this time last year. Internationally, the collective rig count in Brazil, Colombia, and Norway was down 17 percent compared to the last quarter, and these are all meaningful markets for Baker Hughes. In the fourth quarter, activity levels in our International segments are projected to rebound."

Craighead added, "Looking ahead, we are well positioned in growing and emerging markets. Our share in the Gulf of Mexico - the fastest growing deepwater market in the world - has taken a significant step forward through a series of wins this quarter with several major clients. In the North Sea, we are mobilizing to provide integrated drilling services for a very large contract. In the Middle East, we continue to strengthen our Integrated Operations capabilities, and also have been assigned work in the emerging Saudi Arabian unconventional market." Craighead continued, "We will continue investing in technologies, product lines and regions that strengthen the core of our business and supply chain. At the same time, we remain focused on increasing returns through a disciplined approach to capital investment."

The Company recently made the decision to sell its Process and Pipeline Services ("PPS") business. As a result, the Company has reclassified in all prior periods the revenue, expenses, cash flows, assets and liabilities of PPS to discontinued operations. PPS previously was a component of the Industrial Services segment, which now primarily consists of the Company s downstream chemicals and specialty polymers businesses.

The Company was cash flow positive in the third quarter of 2012, as cash increased by $215 million to $1.01 billion compared to the second quarter of 2012. Debt increased by $113 million to $5.15 billion compared to the second quarter of 2012.

Capital expenditures were $732 million, depreciation and amortization expense was $399 million, and dividend payments were $66 million in the third quarter of 2012.

Adjusted EBITDA (a non-GAAP measure) in the third quarter of 2012 was $924 million, down $66 million compared to the second quarter of 2012.

Baker Hughes Operational Highlights

Recent contract awards have made Baker Hughes the leading provider of drilling services in the Gulf of Mexico, both in shallow and deep waters. This reflects Baker Hughes track record of delivery excellence, having drilled through over 130 miles of salt in the Gulf of Mexico, and advanced technology offering, including OnTrak and TesTrak measurement-while-drilling services. In addition, Baker Hughes successfully ran new wireline formation evaluation technologies, significantly improving data quality and reducing deepwater rig time for multiple clients using GeoExplorer high resolution formation imager, our award winning MaxCOR™ rotary sidewall coring tool, and a new service for focused fluid sampling.

Statoil recently awarded Baker Hughes a $500 million two-year contract to provide integrated drilling services in offshore Norway. This contract will cover the delivery of drill bits, directional drilling, measurement and logging-while-drilling, mud-logging services, remote operations and integrated services for 25 offshore fields in the North Sea, Norwegian Sea and the Barents Sea.

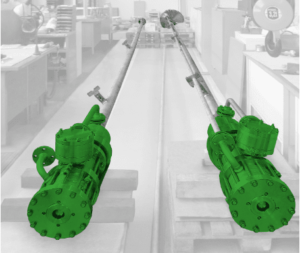

The industry adoption of Baker Hughes AutoTrak Curve rotary steerable system is continuing to gain momentum as reflected in the drilling of over one million feet in the United States during the last four months. At the end of the third quarter, the cumulative footage drilled with this system since its introduction in March 2011 has exceeded two million feet.

Only two years since the OilPump Service acquisition, Baker Hughes has recently reached a significant milestone of 8,000 wells under well management and leasing contracts in Russia. This demonstrates Baker Hughes growing position with key Russian customers in the largest electric submersible pump market in the world.

Baker Hughes high resolution StarTrak logging-while-drilling system recently contributed to significantly improve a large U.S. independent operator s return on investment for 12 wells in the Colorado Wattenberg Basin. Eliminating the need for time consuming dedicated wireline runs represented an operational efficiency improvement of 35 to 70 hours per well. The acquired critical borehole data regarding natural fractures offered the opportunity to significantly improve completion design and effectiveness.

Baker Hughes is expanding its presence in the growing East Africa petroleum province. With estimates of over 100 Tcf of gas in place, this region holds some of the largest global discoveries in recent years. By opening a new facility in Mozambique and mobilizing directional drilling, logging-while-drilling and wireline services, Baker Hughes is ideally positioned to address this growing deepwater market.

Baker Hughes deployed new generation Bi-Fuel Pressure Pumping units operating on both natural gas and diesel fuel in South Texas, leading to reduced fuel costs and emissions. This initiative is currently generating a wide interest from operators across the United States and expected to gain traction throughout 2013.

Source: Baker Hughes, a GE comany LLC