Asian Investment in Wastewater Infrastructure Creates an Expanded Opportunity for Flow and Filtration Equipment

The expansion of sewage transport, primary treatment and secondary treatment in Asia is creating market opportunities for suppliers of pumps valves, scrubbers, chemicals, controls, filters and other water pollution control equipment. These opportunities have been quantified in a number of McIlvaine reports.

The amount of the world s wastewater which will be collected (sewage transport) will expand by 27,000 MGD from 2010 to 2015. The amount treated with mechanical separation (primary treatment) will grow by 16,000 MGD in the same period. Secondary treatment (biological) capacity will reach 160,000 MGD which represents a 15,000 MGD increase. Secondary treatment capacity in the Middle East will grow 23 percent. Asia will account for over 33 percent of the secondary treatment capacity by 2015.

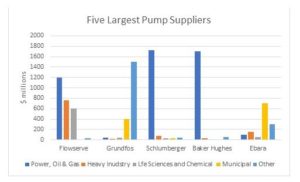

Pumps and valves are used in transport and both primary and secondary treatment. The municipal wastewater valve market will grow to $4.4 billion in 2015 while the pump market will be even higher reaching $8.8 billion.

Centrifuges and clarifiers are used in primary and secondary treatment. The world market for centrifuges in this application will rise to $207 million in 2015. The market for clarifiers and thickeners will be $837 million. The market for all sedimentation and centrifugation equipment for this application will be $1.1 billion.

Belt filter presses and drum filters are used to dewater municipal sludge. The world municipal wastewater sector will spend $568 million for belt filters in 2015. Filter presses and drum filters are also used for dewatering. The total macrofiltration revenues for municipal wastewater in 2015 will be $1.2 billion.

Cross-flow membrane filtration is being increasingly used to make municipal wastewater reusable. Countries such as China with very low rainfall per capita are taking advantage of this new source. The 2015 revenues for cross-flow membranes and equipment for municipal wastewater are projected to be $415 million of which $150 million will be with micro-filtration and the balance with ultrafiltration and reverse osmosis.

The world s municipal wastewater plants will spend $4.5 billion for treatment chemicals in 2015. Of this total, $1.3 billion will be spent on inorganic coagulants while $1.8 billion will be spent for organic flocculants. Nearly $600 million will be spent for odor treatment chemicals.

Odor control solutions will also include a $1.6 billion investment in scrubbers, adsorbers, and biofilters. $800 million will be spent for absorber systems and $450 million for biofilters.

The best way to forecast future sales of water pollution control equipment is to first forecast the amount of water which will be processed. McIlvaine has forecasts for transport and treatment for every country of the world. The installed base in millions of gallons per day (MGD) is used to determine future replacement part sales. The additional capacity forecasts are used to forecast sales of new equipment.

Several of the Middle East countries will be leaders from a percentage standpoint. China will be the leader in terms of quantitative gains.

Source: The McIlvaine Company