8.4 Percent YoY Growth Rate for the Geared Products Market in 2021

Image source: Interact Analysis

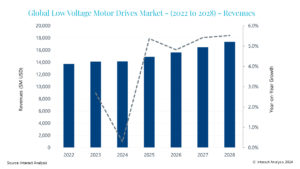

But the market is looking better in the medium-term, with a CAGR of 4.8 percent predicted out to 2025, when the total market value will be $14.1 billion.

In 2021, supply chain problems forced distributors to stockpile and pushed up prices, additionally, surging pent up demand from end users also drove growth, leading to an overall YoY growth rate of 8.4 percent. Economic uncertainty will see the market cool in 2022, with 2023 predicted for the lowest growth rate of the forecast period. Asia Pacific will achieve the highest growth rate globally, with a CAGR of 5 percent out to 2025. In China – the world’s largest market for geared products – effective COVID control has allowed things to continue almost as normal compared to many regions, although EMEA and the Americas are both expected to register a healthy CAGR of 4.7 percent out to 2025.

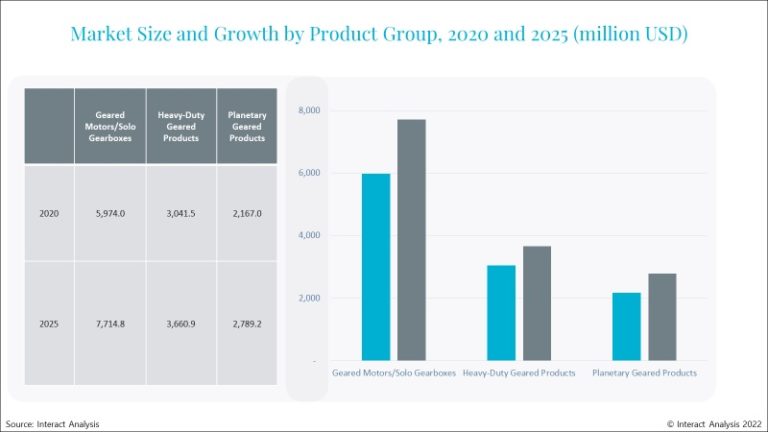

Geared motors and solo gear boxes are the leading product category globally, accounting for 53 percent of total revenues in 2020. They will also be the best performing product category out to 2025, with a CAGR of 5.2 percent. Meanwhile, planetary geared products were the only group to experience growth throughout 2020 due to a surge in demand for wind turbines. Machinery manufacturers were by far the largest consumer of geared products in 2020 with conveyors being the most dominant subcategory. The top 10 end-user sectors, including food and beverage, mining and basic metals accounted for 72 percent of revenues in 2020. As a result of price increases for raw materials, geared motor suppliers were forced to increase unit prices by 3.3 percent in 2021, and prices will not return to pre-pandemic levels until 2024.

Shirly Zhu, Principal Analyst at Interact Analysis, says: “SEW Eurodrive were the only company with a strong market presence in all major product categories in 2020. Leading Asian vendors retained share mainly within their regional markets, whilst European vendors, such as Nord and Bonfiglioli, had relatively strong global presence. Overall, the top 11 suppliers reported a combined market share of 61.5 percent in 2020.”

About the Report: Providing a deep understanding of the market and economic trends driving and restricting growth, the 2nd edition of this well-respected report delivers insight and in-depth analysis into the geared motors and industrial (heavy-duty) gears market.

This report also comes with our “tertiary-level” dataset with deeper analysis of product data by industry by country as the result of the most accurate and detailed segmentation of the geared motors and industrial (heavy-duty) gears market.

Source: Interact Analysis