U.S. Industrial Plants Spend $18 Billion/Yr. for Liquid/Water Flow Control and Treatment

Industry in the U.S. is expanding due to the rising economy. The heavy industrial sector is showing high growth due to the low cost of energy.

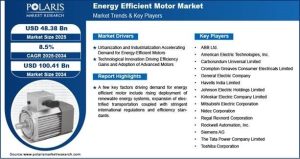

Annual purchases of liquid (including water and process fluids) flow control and treatment products and services will exceed $18 billion/yr.

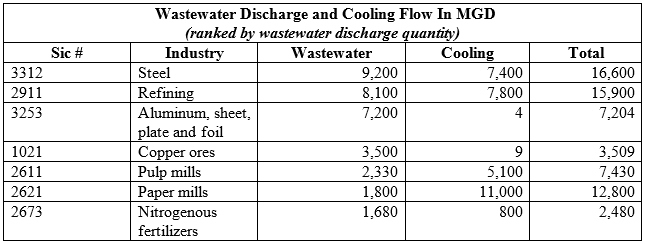

Activities at more than 20,000 plants are tracked by McIlvaine in Industrial Water: Plants and Projects. These plants are segmented into 100 industry categories. A few industries discharge more than 2,000 million gallons /day of wastewater.

The intake water quantity is slightly larger than the water discharged. The largest investment in flow and treatment is due to the recirculation of liquids for process and cooling purposes. This can amount to more than 5,000 MGD in a number of industries. There are more than 1,000 large industrial boilers with substantial treatment systems to purify the water needed for steam generation. Most of these have closed loops with condensate return. A number of smaller industrial boilers also utilize water for steam production but recirculate less water and, therefore, need less purification to avoid concentrating contaminants. Plant expansions requiring liquid flow and treatment equipment are chronicled with continuing updates.

Picture: McIlvaine Company

Source: The McIlvaine Company