Water, Wastewater Treatment Chemicals Companies Are Re-Positioning

As the $26 billion water and wastewater treatment chemicals market shifts to Asia, international companies are re-positioning to maintain share and offset some of the advantages created for local Asian companies. These developments are reported in McIlvaine Water and Wastewater Treatment Chemicals: World Market.

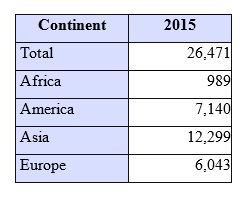

Wastewater and Water Treatment Revenues ($ Millions) (Image: McIlvaine Company)

The 2015 revenues will increase to $26.4 billion of which more than 50 percent will be generated in Asia.

Globalization of the industry includes expansion by Japanese companies into the international market. Kurita Water Industries has purchased APW, the water treatment business owned by Israel-based manufacturer ICL Israel Chemical Ltd (ICL.TA) for ?250 million ($316.94 million).

The transaction, expected to be completed by the end of the year, will help Kurita expand into European markets and also fits with ICL s plan to spin off non-core assets.

Finnish company, Kemira, has opened its biggest water treatment chemicals manufacturing plant at Dormagen (Germany). "Kemira is the market leader in chemical treatment of raw and wastewater in the developed markets. Our Dormagen plant will help us sustain this leadership position in Europe. This plant is also an example of our continuous efforts in improving the resource efficiency of our production plants and operations. It will operate on 100 percent recycled hydrochloric acid, supplied by the TDI-plant of Bayer MaterialScience, from which we manufacture specific water chemicals used successfully in municipal and industrial water treatment applications. This will secure Kemira s long-term, cost-efficient access to this key raw material used in coagulant manufacturing," said Jari Rosendal, President and CEO, Kemira.

The clear benefits that the Dormagen location brings are explained by Frank Wegener, Managing Director of Kemira Germany GmbH, "In addition to well-established site infrastructure, including the high standard of safety and protection due to the plant design and plant fire brigade, Kemira highly values the optimal transport connections and proximity to our markets in the Benelux countries, Germany and parts of France. Chempark Dormagen is very centrally located and offers us all opportunities to carry our product optimally, presently by truck and, looking ahead, also by rail tank cars."

OCI Company Ltd., the world s leading manufacturer of solar-grade polysilicon and other chemical products, has disposed of its wastewater treatment unit as part of an effort to improve its financial standing due to the downturn in the solar business. The environmental chemical 50:50 joint venture OCI-SNF was sold to the French partner SNF at the cost of 95.7 billion won.

Established in 1998 jointly with SNF of France that was a dominant player in the world s flocculant (or polymer coagulant) market, OCI-SNF currently accounts for 60 percent of Korea s market and posted 160.2 billion won in sales revenue on 17.4 billion won operating profit last year.

The U.K. s leading advanced anaerobic digestion and integrated biogas-to-energy businesses with over 200 installed anaerobic digestion systems, Monsal has particular expertise in optimizing anaerobic digestion assets to create strategic renewable energy centers for the water and waste markets.

Clariant, a company dealing with specialty chemicals, announced that it has closed the sale of its water treatment business in Africa to AECI, domiciled in South Africa. The total value of the divestment amounts to CHF 34 million in cash at closing. The transaction was subject to certain precedent conditions, as well as regulatory approvals.

AECI is an explosive and specialty chemicals group domiciled in South Africa and its businesses are characterized by application know-how and service delivery in many African countries. It already has a footprint in the industrial water and municipal and wastewater markets in South Africa, supplying a total water solution to its customers.

Source: The McIlvaine Company